Photo Gallery

|

|

DataDome Account Protect

Additional Info

| Company | DataDome |

| Company size | 100 - 499 employees |

| World Region | North America |

| Website | datadome.co |

NOMINATION HIGHLIGHTS

Account fraud, particularly account takeovers, has surged in complexity and frequency, presenting a significant – and costly – challenge for businesses. According to Juniper Research, account takeover fraud cost US businesses a staggering $25.6 billion in 2020, a 500% increase from 2017. The US FTC reports that ATOs and identity theft made up 35.62% of all fraud reports received in 2022. Account Fraud inflicts substantial financial losses, tarnishes brand reputation, and drains team resources. While existing solutions have attempted to address this issue, they often fail to effectively combat the sophisticated tactics employed by fraudsters. Enter DataDome Account Protect.

DataDome Account Protect goes beyond conventional approaches to detect account-related attempts with fraudulent intent. Using advanced detection techniques, Account Protect analyzes new signals collected directly from customers’ applications, including user-specific identifiers like email addresses and geographical locations, in real time and over a meaningful timeframe to draw the most accurate insights into user intent.

By leveraging DataDome’s Account Protect, enterprises can effectively thwart user-centric fraud attempts before they wreak havoc on businesses. This solution offers comprehensive protection against the evolving threat of account fraud, protecting against financial losses, preserving brand integrity, and optimizing team efficiency.

Case in point -> When a leading luxury brand encountered significant hurdles with its online booking system, grappling with a surge in sign-ups, reaching between 100k and 300k daily, it turned to DataDome. Account Protect uncovered a staggering 75% of these sign-ups were fraudulent. Implementing DataDome’s solution proved highly successful, showcasing an impressive false positive rate of only 0.00091%. This empowered the brand to reclaim control over their sign-ups, diminish “no-show” appointments, and redirect their focus toward authentic customer interactions, enhancing their booking experience.

For more info, visit: https://datadome.co/products/account-protect/

Key Capabilities / Features

DataDome Account Protect emerges as enterprises' frontline defense against account fraud, not merely reacting to threats but preemptively preventing them. This innovative solution safeguards enterprises from the financial, reputational, and resource drain that fraud induces. With Account Protect, businesses maintain a strategic advantage over fraud.

Proactive Fraud Prevention: DataDome Account Protect significantly reduces exposure to account fraud at critical user interaction points, thereby protecting users and brand reputation. Advanced algorithms identify suspicious login activities, such as unusual login locations or login attempts from unfamiliar devices, thwarting potential theft of store credit, account balances, loyalty reward points, or miles. It protects against account fraud by stopping every attempt in real-time every time.

Financial Integrity and Optimized Resources: DataDome Account Protect proactively prevents chargebacks and circumvents financial institution penalties and fines, thus preserving revenue and avoiding the financial pitfalls of disputed transactions. Automating fraud detection and blocking allows businesses to reallocate focus towards growth and innovation, enhancing operational efficiency. This strategic advantage enables teams to dedicate their efforts to scaling business and realizing strategic objectives.

Dynamic Risk Evaluation: DataDome Account Protect provides a continuous risk assessment that evolves with every user interaction, from login to checkout. This dynamic evaluation equips businesses with the foresight to preemptively counteract threats such as malware, phishing, spam, and inappropriate content.

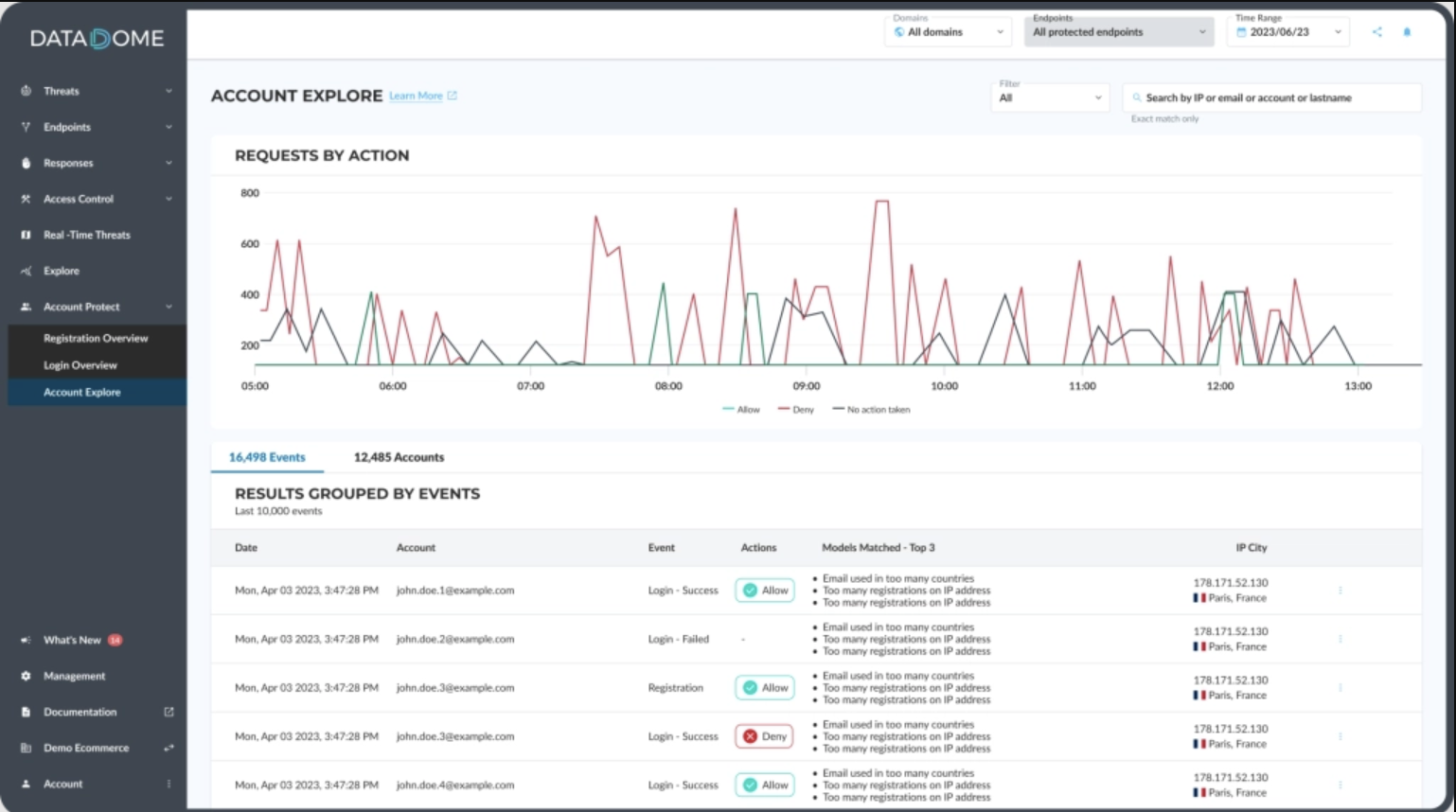

Empowering Decisions with Enhanced Insights: Transparency and control are central to DataDome Account Protect. DataDome's intuitive dashboard offers comprehensive, easily navigable insights into user and account activities. Enterprises can decode protection actions, dissect threats by login and registration attempts, and effectively manage outcomes. These insights empower decision-making, granting enterprises the upper hand.

Unwavering Privacy Compliance: DataDome Account Protect goes beyond GDPR and CCPA standards, ensuring user data is protected and privacy rights are upheld.

How we are different

DataDome Account Protect distinguishes itself by setting a new standard in account fraud prevention through the following key differentiators.

Stopping Fraud Before it Happens: Many existing solutions can only identify and remediate account fraud after the damage is done. DataDome Account Protect pioneers by stopping fraud before it does damage. It collects a sophisticated digital footprint of user behavior, leveraging user-centric and business signals to pinpoint and disarm suspicious activity with unparalleled accuracy.

Unmatched Comprehensive Protection: DataDome Account Protect sets itself apart by offering a blanket of security that covers every digital touchpoint—be it websites, mobile apps, or APIs, the latter being a battleground for nearly half of ATO incidents. This holistic approach ensures enterprises enjoy a uniform and unwavering defense mechanism across all domains, contrasting with competitors focusing on singular aspects of online presence. DataDome's robust system is designed to safeguard against a wide array of online threats, offering peace of mind in a landscape often marred by fragmented security measures.

Unrivaled Transparency and Insight: While others may leave enterprises grappling with opaque outcomes and scant data, DataDome Account Protect highlights the intricacies of fraud detection and prevention. DataDome's intuitive dashboard delivers detailed, real-time analytics and comprehensive reports, empowering users with the knowledge to understand and evaluate the efficacy of their defenses against account fraud. This level of transparency demystifies the process for incident response teams and enables business units to grasp the rationale behind security measures, fostering an environment of informed decision-making and strategic planning.

Vote by Sharing

- Like

- Digg

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- SMS

- Viber

- Telegram

- Subscribe

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Each completed social share counts as a vote for this award nomination.