Photo Gallery

|

|

IDENTIKEY Risk Manager

Additional Info

| Company | VASCO Data Security International, Inc. |

| Company size | 500+ employees |

| Website | http://www.vasco.com |

NOMINATION HIGHLIGHTS

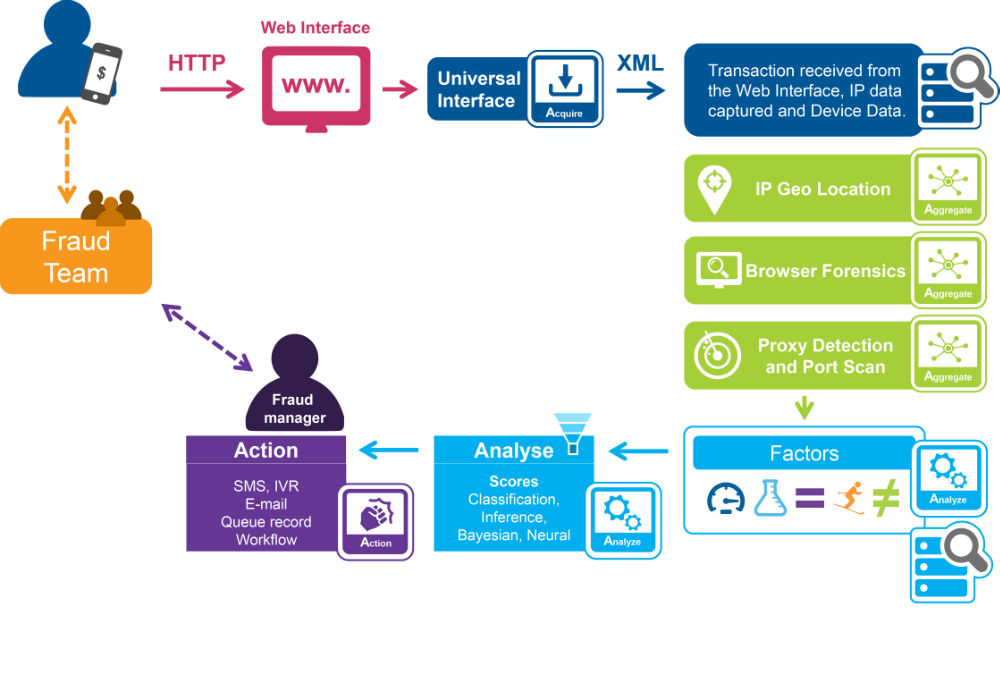

Financial institutions are prime targets for electronic fraud and need to closely – yet very rapidly – assess transactions for potential fraud. At the same time, their consumers increasingly demand a frictionless transaction experience. IDENTIKEY Risk Manager (IRM) is a comprehensive fraud detection/risk management solution to help improve the manner and speed at which organization detect fraud across multiple channels.

IDENTIKEY Risk Manager combines sophisticated, real-time risk analysis, multi-channel transaction monitoring and risk-based authentication to deliver an innovative solution for fraud prevention and compliance. IRM identifies and scores risks in real-time and at critical steps to determine risk levels and initiate protective action when suspicious patterns and/or relevant factors (such as untrusted networks, for example) are identified. It helps organizations proactively prevent fraud while delivering a frictionless experience to delight users.

The unique approach is based on (mobile) Runtime Application Self Protection (RASP) capabilities – which proactively shield apps from malware, and maintain application integrity even if the environment is infected/hostile – and strong 2FA. IDENTIKEY Risk Manager’s ‘Step Up’ Authentication escalates to require additional user authentication based on the user’s risk factors and the activity.

The multi-channel transaction monitoring capabilities of IRM detects fraudulent activities across any application, enabling organizations to quickly respond to evolving fraud patterns, comply with regulatory mandates, and improve operational efficiency. By identifying unusual patterns and behaviors, and stepping up security with risk-based authentication where required, IRM creates a more secure environment in a way that does not impact user experience.

IRM collects, analyzes and scores activities and operations in real time. It identifies risk at critical steps, predicts risk levels and takes quick action when fraud patterns are identified. By offering its customers a frictionless, secure and convenient banking solution, the institution no only secures transactions, but also fortify its brand and ensures customer retention.

How we are different

• VASCO’s IDENTIKEY Risk Manager solution combines highly robust and proactive fraud prevention with true end-user convenience. Most transactions will pass without extra authentication acts. If a transaction seems suspicious, additional measurements are taken with the speed and efficiency defined by the customer’s policies and needs, and additional verification steps are offered to the consumer.

• This secured environment thwarts fraud attacks, reducing both institutional losses and potential compromise of reputation and end-customer trust.

• Costs are perfectly predictable, as scalability can be achieved without incremental costs. Costs are linked to a user, and not to the amount of transactions or number of devices.

Vote by Sharing

- Like

- Digg

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- SMS

- Viber

- Telegram

- Subscribe

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Each completed social share counts as a vote for this award nomination.