Photo Gallery

|

|

Memcyco PoSA: Preemptive Cybersecurity Solution

Additional Info

| Company | Memcyco |

| Company size | 40-69 employees |

| World Region | Middle East |

| Website | https://www.memcyco.com/ |

NOMINATION HIGHLIGHTS

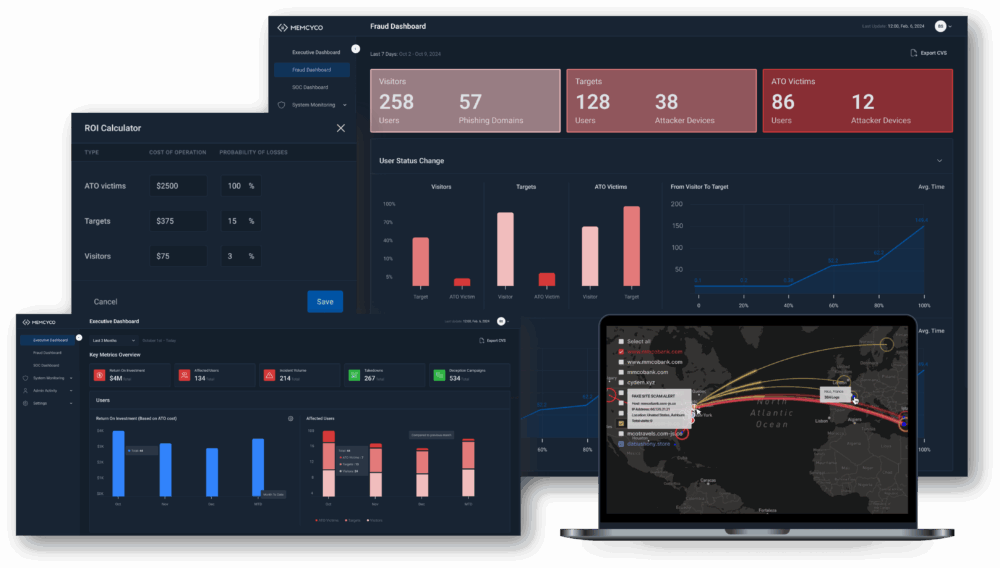

Most fraud prevention today is focused on transaction monitoring: analyzing payments, logins, and behavioral anomalies once fraud is already underway. Memcyco shifts prevention further upstream, protecting organizations and their customers before fraud ever reaches the transactional layer.

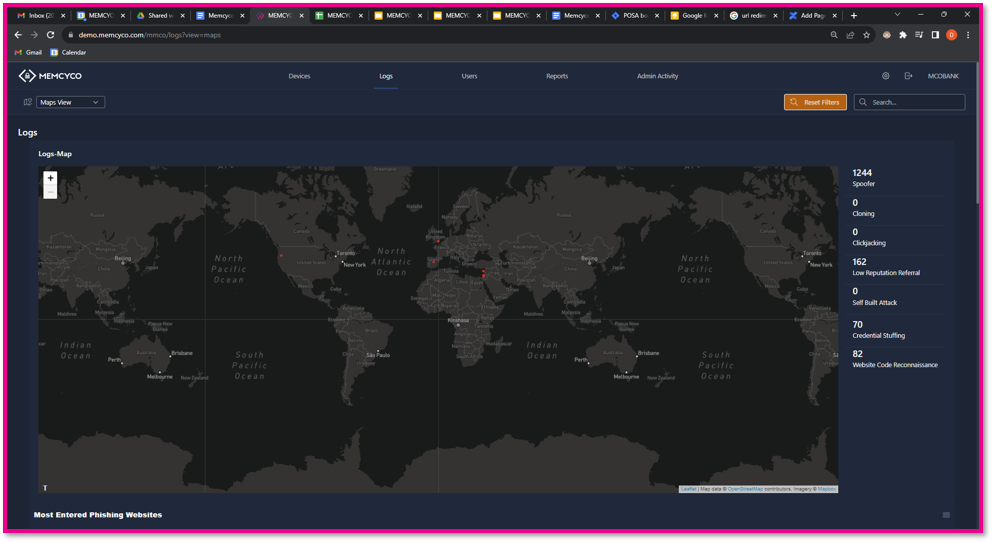

Memcyco prevents phishing, brand impersonation, credential theft, and account takeover (ATO) by detecting and disrupting attacks in real time, during the user’s session. Instead of waiting for compromised credentials to be used, the platform identifies impersonation attempts immediately and neutralizes them. This allows fraud teams to address scams at the point of credential harvesting, rather than reacting after fraudulent transactions occur.

When a user lands on a spoofed site, Memcyco injects decoy credentials, rendering stolen data unusable and exposing replay attempts if attackers try to use them on the legitimate site. Its Nano Defenders, silently embedded when a site is cloned, activate during the attacker’s build, test, and launch phases, providing visibility into spoofed sites across their lifecycle, including attacker testing and live use.

The platform also strengthens defenses against account takeover campaigns. Memcyco detects both successful and failed credential stuffing attempts during login flows, significantly reducing false positives while giving fraud teams a clear picture of attacker behavior. Its persistent, session-aware device fingerprinting creates a strong, behavior-based link between users and devices. This allows predictive ATO risk scoring and dynamic reclassification of risky devices, even if they were previously trusted.

Key innovations relevant to fraud prevention include:

- Detection of both successful and failed credential stuffing attempts during login flows, significantly reducing false positives

- Decoy data injection to render harvested credentials unusable and track attacker reuse

- Nano Defenders for visibility into spoofed sites across their lifecycle, including attacker testing and live use

- Advanced device fingerprinting to establish persistent, session-aware user-device pairings, with dynamic risk reclassification

- Victim-level attribution, showing which customers were targeted and what data was entered into spoofed sites

Memcyco integrates via API with fraud engines and SIEM platforms, requires no SDKs or agents, and introduces no customer friction. It complements existing fraud systems by closing the blind spot before compromise, reducing reimbursement costs, customer churn, and operational workload.

In 2024, Memcyco was selected as a partner by Deloitte and featured in Datos Insights’ Q1 2025 Fintech Spotlight. Its platform is deployed across banking, eCommerce, travel, and logistics, where it delivers measurable reductions in fraud losses by preventing credential theft and impersonation-driven scams before they escalate into transactions.