Photo Gallery

|

|

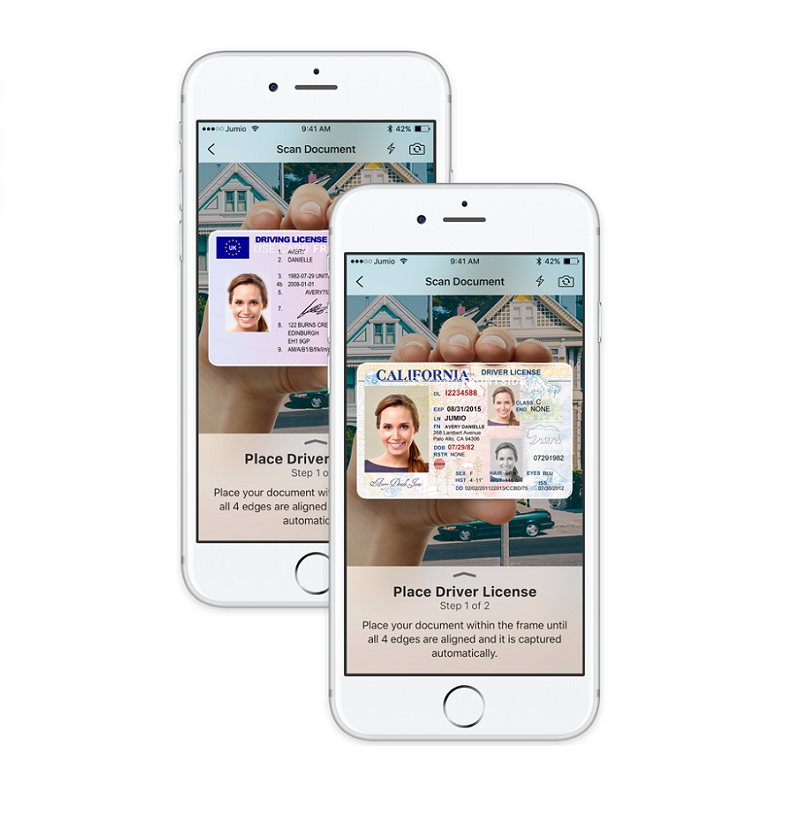

Netverify® - AI-Powered Digital Identity Verification

Additional Info

| Company | Jumio |

| Company size | 1,000 - 4,999 employees |

| Website | https://www.jumio.com/ |

NOMINATION HIGHLIGHTS

In an ever-growing digital world, verifying your customer’s real-world identity to their digital one can be daunting. As cybercriminals become increasingly savvy, mitigating fraud risk is essential to a business’s bottom line, as well as the consumer experience. Jumio gives its customers a definitive yes or no decision about whether to accept or reject an online verification transaction with the highest accuracy rates in the industry.

Jumio uses a hybrid approach to thwart fraudsters. In addition to artificial intelligence (AI), machine learning, biometric facial recognition, eyeball tracking and computer vision technologies, Jumio also leverages human verification experts who can detect fraud that AI algorithms often miss. Jumio quickly and accurately verifies the authenticity of an ID, a document, or real-world identity in seconds — not hours or days — helping customers optimize conversions, deter fraud and meet compliance mandates (Anti-Money Laundering, Know Your Customer and GDPR).

Jumio’s identity verification solutions, which include ID Verification, Identity Verification and Document Verification, have been adopted by leading companies in the financial services, sharing economy, retail, travel, cryptocurrency and online gaming sectors – including Airbnb, United Airlines, HSBC, Instacart and more.

Collectively these companies perform close to 300,000 verifications every day which provide a massive competitive advantage in terms of training its machine learning algorithms. These AI models have reduced the average customer transaction time by 10 percent, with more significant reductions to come. These technologies are improving Jumio’s ability to detect fraud while also improving the user experience. Over the last 12 months, Jumio approved 99.97 percent of valid transactions and rejected 91.64 percent of invalid or fraudulent transactions.

How we are different

- KBA & 2FA Replacement: Knowledge-based authentication (KBA) is an authentication process in which the user is asked to answer at least one “secret” question. Due to a steady stream of massive data breaches, chances are high that fraudsters already have access to the answers of a user’s security questions. As of July 2016, NIST no longer recommends two-factor authentication (2FA) systems that use SMS, because they are easily bypassed if a phone is lost or stolen. This results in many enterprises abandoning KBA and 2FA for biometric-based online identity verification for a more secure and reliable authentication platform.

- Machine Learning: Machine learning (ML) for online identity verification relies on having a large database of good and bad (i.e. fraudulent) transactions. The larger the dataset, the smarter the algorithms. Because of its history with some of the largest global brands, Jumio has a significant head start on its competition, using its database of 150-million plus online verifications to better train its ML algorithms.

- Improved User Experience: Jumio returns additional information about why an ID was rejected (e.g. the picture was taken in poor light) to its business customers in near real-time. These extra details are being used to help their customers course correct (e.g. retake the picture with better lighting) to improve conversion rates and lessen abandonment rates.

Vote by Sharing

- Like

- Digg

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- SMS

- Viber

- Telegram

- Subscribe

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Each completed social share counts as a vote for this award nomination.