Photo Gallery

|

|

|

NuData, a Mastercard company

Additional Info

| Company size | 100 - 499 employees |

| World Region | North America |

| Website | nudatasecurity.com |

NOMINATION HIGHLIGHTS

NuData Security provides an award-winning solution that accurately identifies whether a new or known user is behaving suspiciously inside an account. We look at what makes the user inimitable: their behavior. As the owner of the world’s largest behavioral network, NuData monitored over 650 billion behavioral events in 2019 alone. This intelligence is fed to machine learning and real-time models to continually identify legitimate or fraudulent activity as it evolves and mitigates before any damage.

Our technology helps brands offer a better user experience to end-users, while mitigating evolving threats. As more people move online, bad actors take the opportunity to sharpen their tools and make their attacks more human-like to bypass controls. However, by looking at passive biometrics signals and behavioral analytics, NuData solutions can see who is behind the device. Thanks to our solutions, our clients can not only tell humans and scripts apart, but also whether a human is the legitimate user for a given account, all without adding friction or additional authentication steps.

The NuData technology has different models for each use cases, such as account takeover attacks at login, fraudulent transactions/purchases, or fraudulent credit applications. This helps prevent risk and streamline good users at any stage during a session.

Many of the world’s most trusted brands now depend on NuData solutions to streamline their customer relationships, and to detect and prevent fraud – strengthening customer loyalty, customer revenues and brand reputation. NuData is known for its continuous customer support with dedicated teams assigned to its partners and clients, supporting during and implementation, and throughout the entire relationship. With its global clients, partnerships, and one-to-many solutions, NuData is rapidly growing its network that, in turn, enhances its solution, models, and machine learning capabilities to become more accurate, efficient, and successful in mitigating fraud.

How we are different

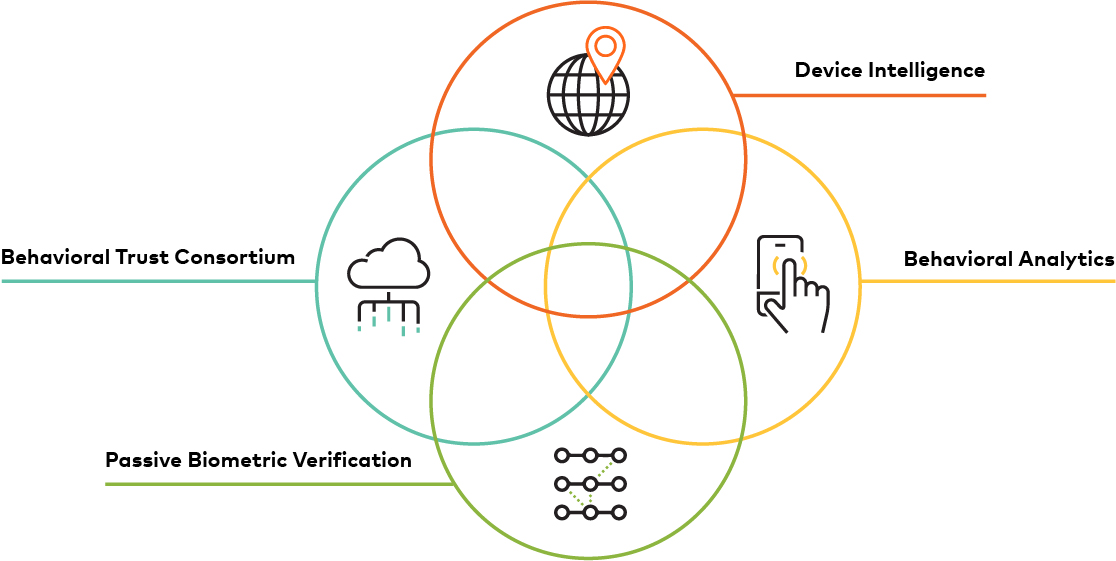

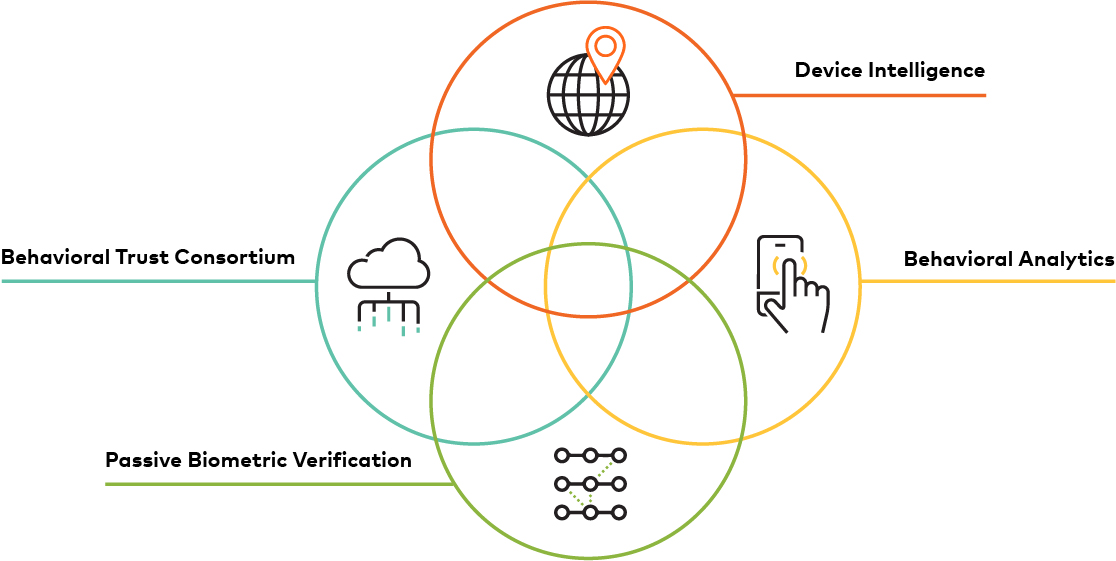

• Four layers of intelligence: NuData is the only company offering an integrated, multi-layered solution that builds a user identity through four layers of intelligence. Each integrated layer focuses on a critical type of intelligence: device location and connection, behavioral analytics, passive biometrics, and a syndicate of aggregated data with billions of data points that are hashed and anonymized within the Trust Consortium.

• Compliant with PSD2 regulation and connection to EMV 3DS protocol – soon FIDO: Not many tools that provide our services also provide connection to EMV 3DS or PSD2 compliance, making this a notable point of difference from our competitors. For example, NuData solutions can automate how a user must be verified if the transaction happens under PSD2. As a Mastercard company, NuData is a certified solution that can offer connection to EMV 3DS and allow companies to know the level of risk of a purchase before processing it.

• Unparalleled bot detection: Common sophisticated bots today can mimic human mouse and typing patterns. NuData technology can detect any type of bot by looking at parameters such as the typing pattern, the device information, and the device angle information among others. Furthermore, there is a next generation of bots that deploy hybrid attacks – meaning when they encounter a challenge they can’t bypass, such as a complex CAPTCHA, they send that challenge to a human in a human farm to solve it. NuDetect for Account Takeover has visibility into these types of behaviors to mitigate attacks, even if the script is combined with human work.

• No added friction: Our solution leverages passive biometrics and behavioral data that provides a streamlined and frictionless experience for end-users, enabling clients to add additional security steps such as verification requests or challenges only when there is high risk.

Vote by Sharing

- Like

- Digg

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- SMS

- Viber

- Telegram

- Subscribe

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Each completed social share counts as a vote for this award nomination.