Photo Gallery

|

|

Sift Digital Trust & Safety Suite

Additional Info

| Company | Sift |

| Company size | 100 - 499 employees |

| Website | http://www.sift.com |

NOMINATION HIGHLIGHTS

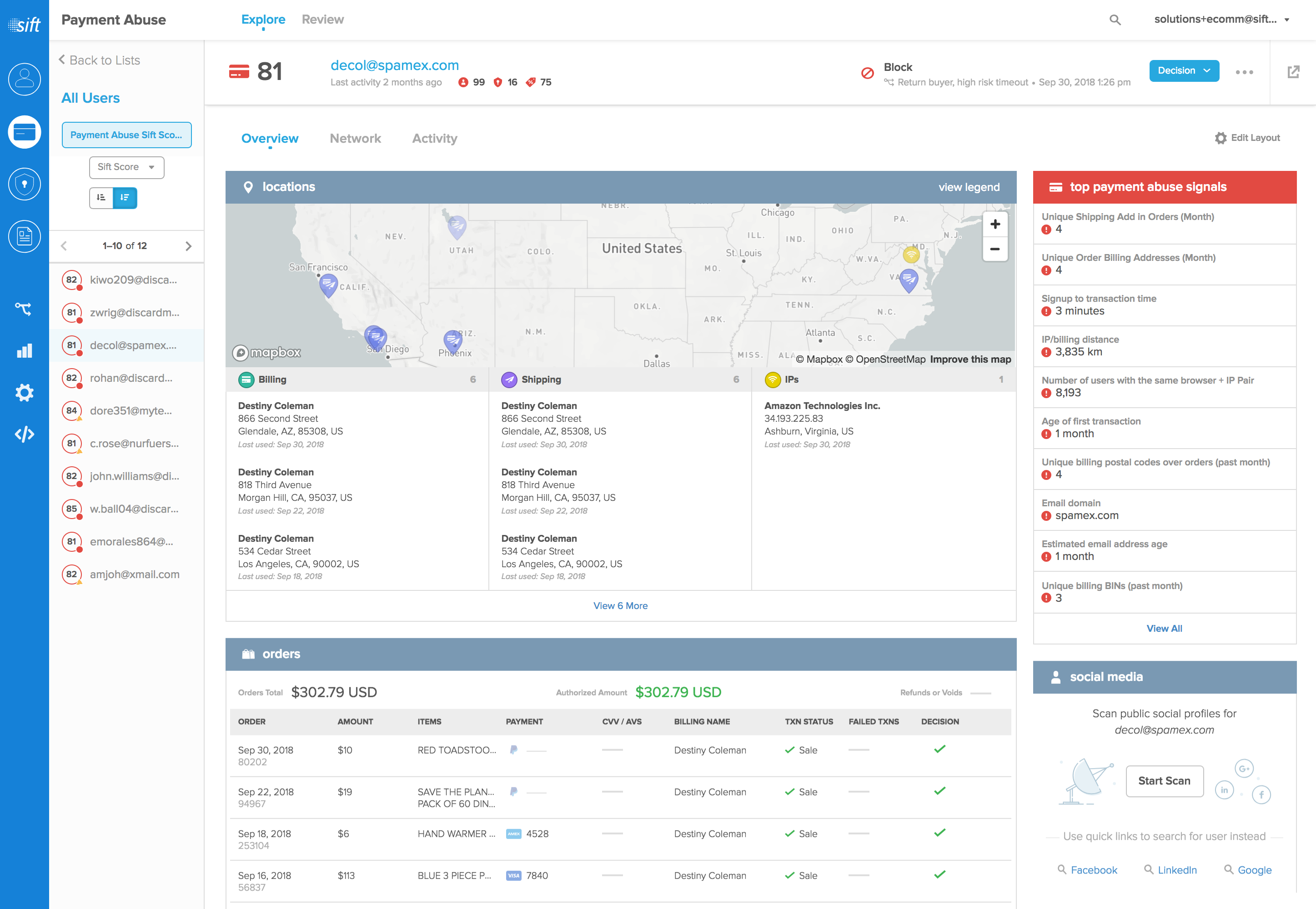

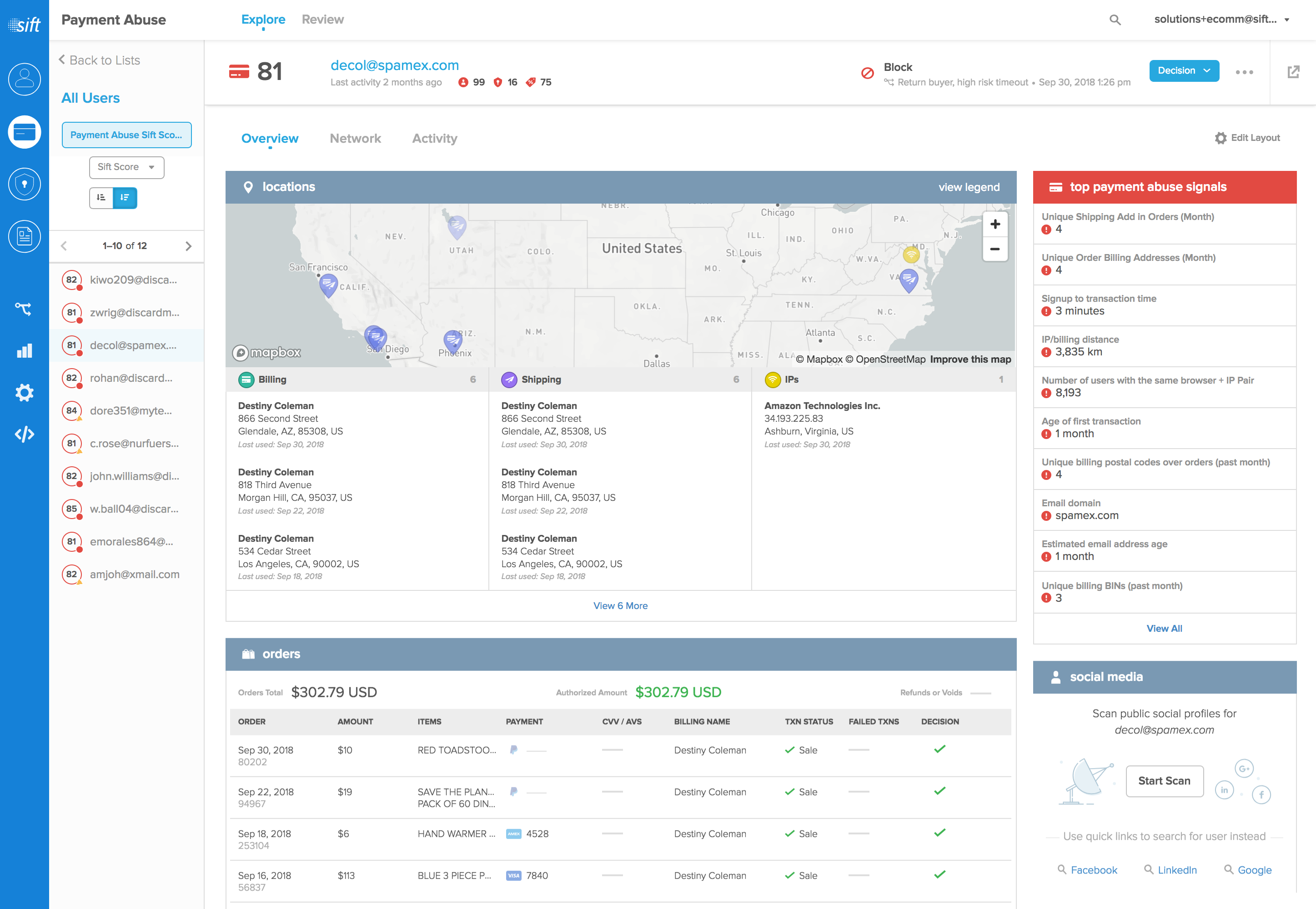

With the rise of the pandemic, fraud has become an ever-evolving challenge that can only be combated with a dynamic and innovative fraud solution. That’s why Sift zeroed in on transforming its Digital Trust & Safety (DT&S) Suite into a central nervous system for fraud fighters to protect against abuse. Some of the largest digital companies in the world— including Twitter, McDonald’s, DoorDash and Wayfair— trust Sift’s holistic platform to prevent fraudsters from buying items with stolen payment information, taking over user accounts, scamming other customers, or filing faulty chargeback claims – all while reducing friction for legitimate customers.

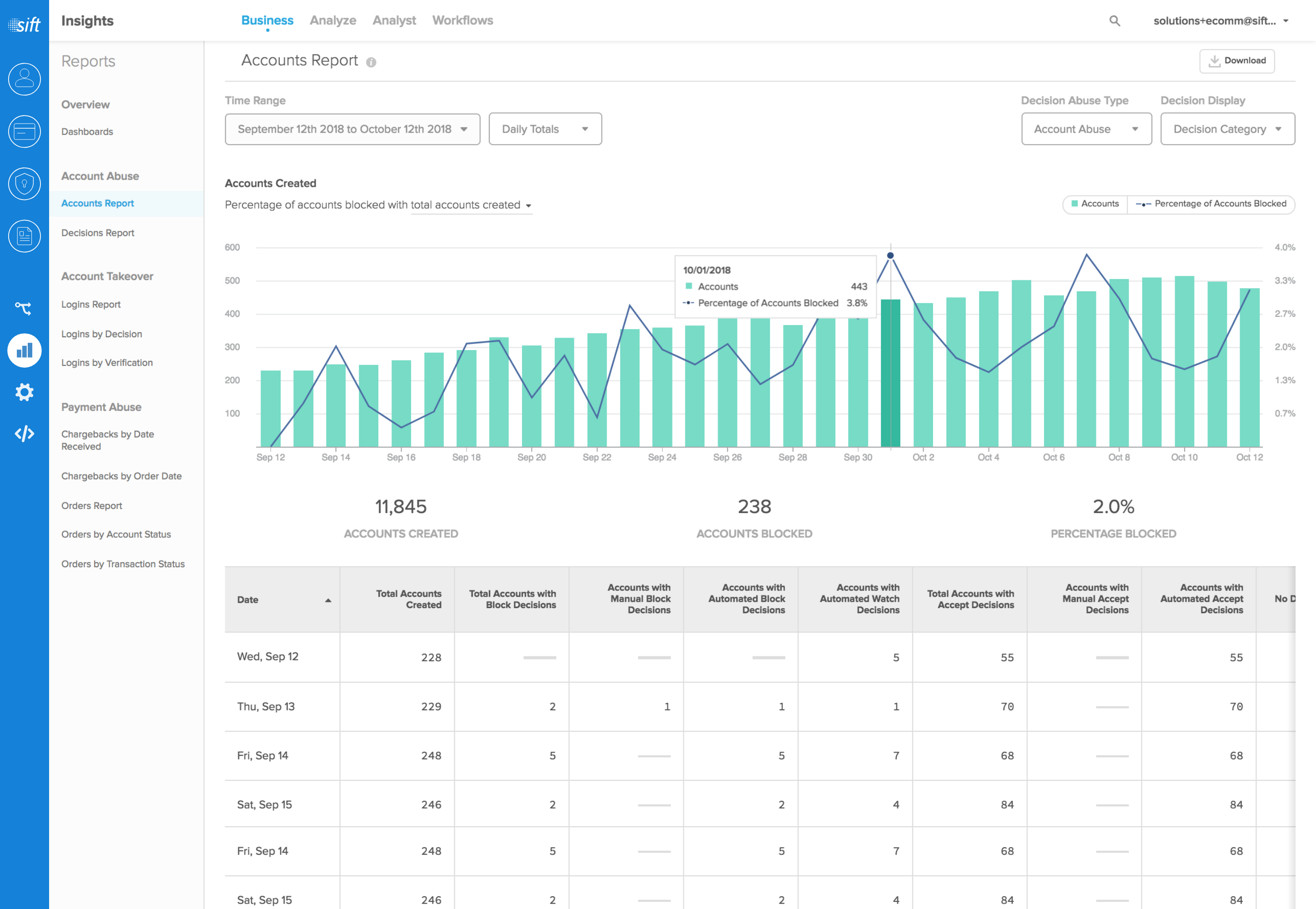

Sift’s DT&S Suite is powered by real-time machine learning and assesses the risk of all live events taking place across customers’ global networks. With over 34,000 sites and apps using the DT&S Suite, the solution collects, analyzes, and learns from hundreds of millions of positive and suspicious events each day. Sift produces real-time risk scores for every interaction along the user journey, including account creation, logins, orders, content posting and custom events, so customers can make instant and accurate decisions about the legitimacy of user actions. The DT&S Suite provides:

Payment Protection

– Proactively stops fraudulent chargebacks and protects revenue

– Streamlines operations and reduces manual review

– Grows revenue with decreased false positives and increased conversions

Account Defense

– Blocks fake accounts and fraudulent sign ups

– Stops account takeover attempts and secures legitimate user accounts

– Reduces friction for legitimate users

Content Integrity

– Reduces fraudulent content like spam and scams

– Safeguards a company’s brand and creates better user experiences

– Allows trust and safety professionals to work efficiently and automate comments/reviews.

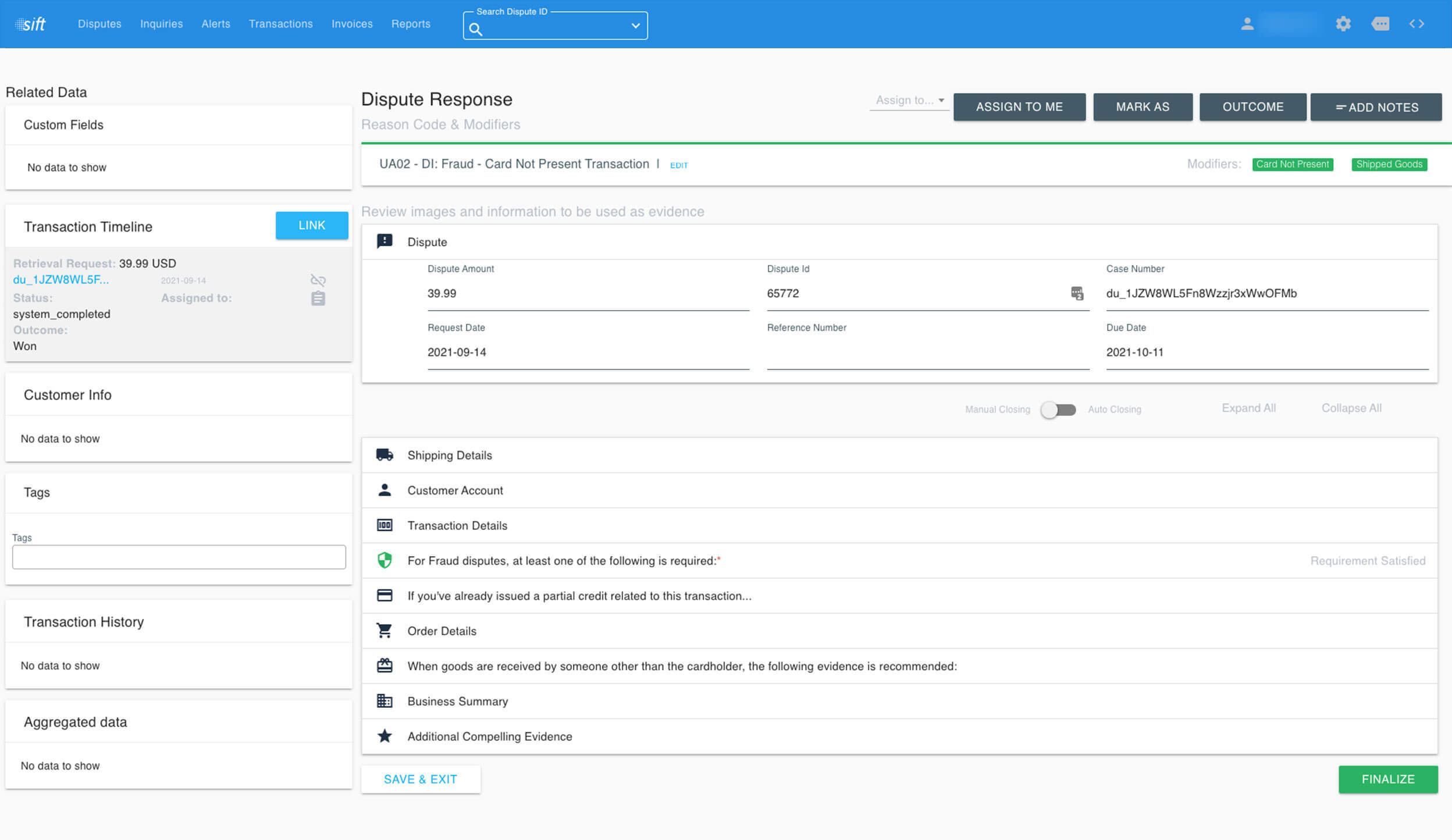

Dispute Management

– Prevents fraudulent disputes and lowers dispute rates to minimize losses

– Accesses data needed to generate comprehensive dispute responses

– Reduces time spent researching, crafting and submitting dispute responses

How we are different

Unlike its competitors, Sift uses machine learning models to detect multiple types of fraud (payment fraud, fraudulent content, account takeover, promotion abuse, friendly fraud, and fake accounts), while identifying legitimate actions in real-time. With over 34,000 sites and apps on the platform, Sift evaluates 70 billion events and analyzes millions of global fraud decisions every month. The net result is a 30% increase in the accuracy of Sift’s machine learning predictions. For example, car share marketplace, Turo, experienced a 98% reduction in overall fraud and blocked 100% of account takeover attempts when using Sift’s platform.

As the pandemic accelerated online fraud, Sift zeroed in on creating a holistic solution that prevents abuse across entire transaction lifecycles. In 2021, Sift made two strategic acquisitions – Keyless and Chargeback – to further grow its DT&S Suite into a central nervous system for customers from F500 to startups to protect against abuse while growing revenue. By leveraging Keyless’ biometric-based authentication in its Account Defense solution, Sift is providing customers with biometric security that eliminates account takeover fraud due to weak or stolen passwords, phishing and credential reuse. The Chargeback integration arms fraud teams with an end-to-end view of transactions enabling them to lower dispute rates, saving them time and money.

Rather than taking a myopic approach towards stopping fraud, Sift has observed how bad actors adopt different channels and vectors to steal from businesses and created a full platform for stopping them. Sift’s machine learning-powered global data model benefits from the company’s massive network effects: the more customers that Sift has, the smarter its models become. By looking beyond fraud to understand the digital experience as a whole, the company created a broad, new approach to designing user experiences that don't treat risk and revenue as mutually exclusive.

Vote by Sharing

- Like

- Digg

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- SMS

- Viber

- Telegram

- Subscribe

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Each completed social share counts as a vote for this award nomination.