Photo Gallery

|

|

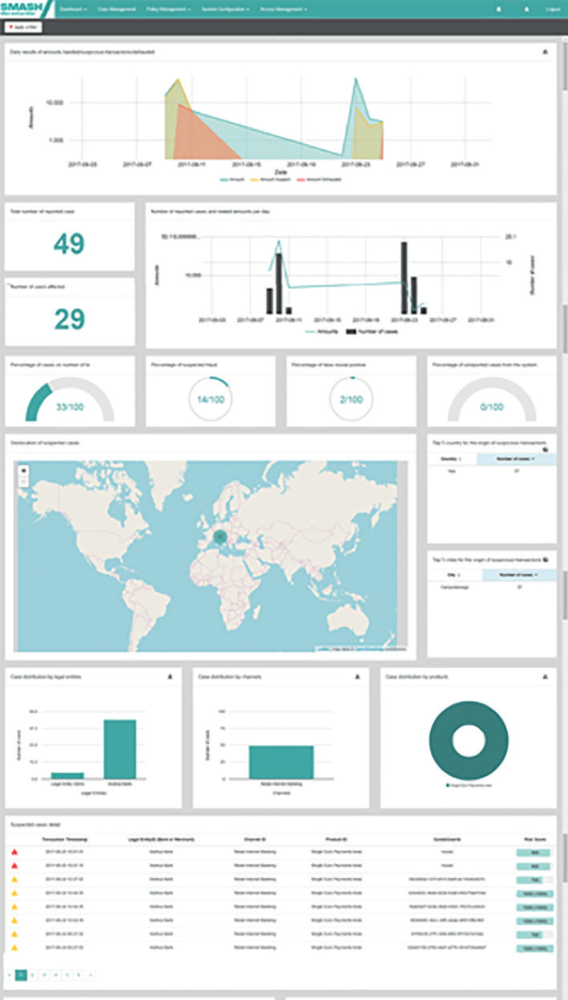

SMASH SMart Antifraud SHield

Additional Info

| Company | XTN Cognitive Security |

| Company size | 10 - 49 employees |

| Website | http://www.xtn-lab.com |

NOMINATION HIGHLIGHTS

FACE EFFICIENTLY THE FRAUD CHALLENGE WITHIN PAYMENT SYSTEMS

SMASH® “learns to recognize” users of online payment services and their usual behavior. Thanks to proprietary algorithms based on machine learning techniques, it is able to analyze and to correlate hundreds of parameters; this information is correlated and matched with normal user’s behaviors, determining in real-time a risk score for every transaction.

The Analytics module extends SMASH® capabilities in the investigation of suspected events providing “snap-in” views of user activity and behavior, transaction analysis, relationship between entities involved in the transaction.

How we are different

- SMASH® is able to drastically reduce the number of frauds. It provides different deployment scenario, in particular the possibility to be deployed without the need to modify the monitored application.

- SMASH® engine is focused on machine learning behavioral analysis algorithms which are customizable by the user through an integrated tool within the console.

- SMASH® offers incident management, analysis features and a built-in case

management that implements a workflow designed according to real operative

needs, and it is able to reduce the effort to manage frauds in their entire lifecycle. SMASH® combined with its modules (Endpoint Protection and Smart Authentication) is the unique platform who can provides a full matching with the PSD2 Regulation.

Vote by Sharing

- Like

- Digg

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- SMS

- Viber

- Telegram

- Subscribe

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Each completed social share counts as a vote for this award nomination.