Trustmi, the leader in business payment security, has protected billions of dollars and tens of millions of business transactions

Recognized in the Category:

Photo Gallery

|

|

Trustmi, the leader in business payment security, has protected billions of dollars and tens of millions of business transactions

Additional Info

| Company | Trustmi |

| Company size | 10 - 49 employees |

| World Region | Middle East |

| Website | https://www.trustmi.ai/ |

NOMINATION HIGHLIGHTS

Cyberattacks on business payments are a growing issue, yet organizations have lacked an end-to-end solution that effectively secures and helps them avoid scams associated with their payment processes.

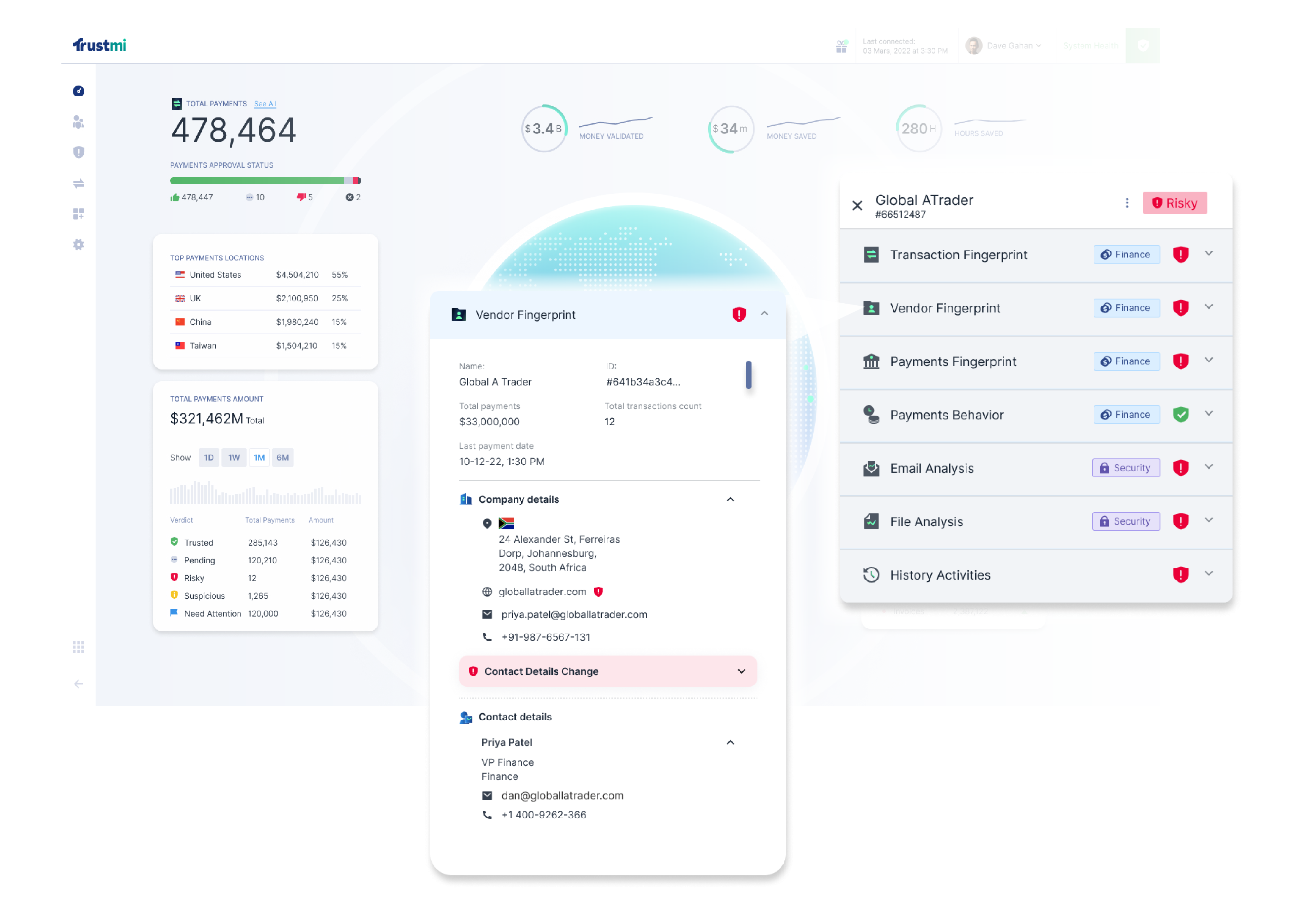

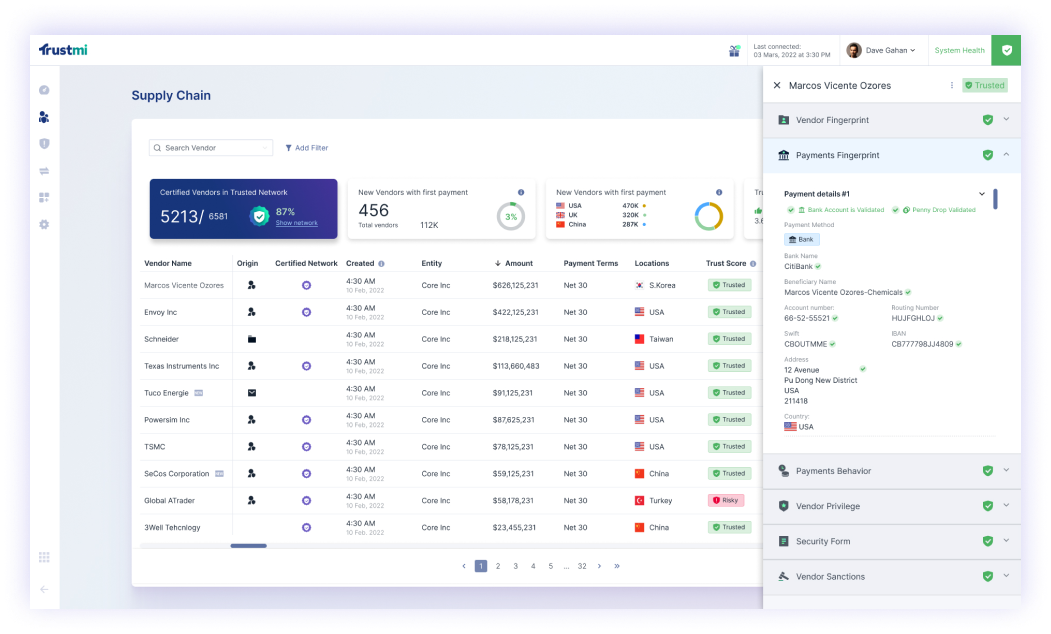

In July 2023, Trustmi introduced the industry’s first end-to-end business payment solution that helps companies protect their bottom line by eliminating losses from cyberattacks, internal collusion, and human error, ensuring payments go to the right place. Trustmi’s solution enables finance and security teams to more effectively and efficiently secure payment processes and manage vendors by connecting payment data and activity across an organization’s siloed systems.

Trustmi’s AI-powered platform provides a full view of companies’ historical payment flow data and analyzes hundreds of data points to create a baseline for each vendor of all their profile data, communication, and activity. This data helps uncover vulnerabilities across the entire payment flow, including the vendor supply chain and detects anomalies in the vendor’s behaviors and information, including all activity within the payment flow. Trustmi then flags any suspicious activity and can stop payments that show a breach in the email communication and throughout the payment process. The platform can also stop payments from being sent to the wrong place. Trustmi takes a highly quantitative approach to prevent payment losses and deliver immediate value to businesses across all industries.

Trustmi’s platform does not change any payment processes. It is a flexible solution that seamlessly layers onto existing finance systems to secure business payments across the entire payment workflow, boosting efficiency and reducing manual work. The easy-to-use interface allows full control so businesses can run their payment processes without changing or interrupting their workflows.

“Trustmi provided transparency into our payment process to see where cyberattacks and errors were happening and full protection without changing our workflow.” Wayne Lawrence, SVP, Data Platforms – Global Information Technology at Colgate-Palmolive Co.

Key Capabilities / Features

Trustmi’s AI-powered B2B payment security platform empowers organizations to take a proactive, automated approach to securing their business payments.

Trustmi’s vendor onboarding and supply chain management modules automate and secure the vendor lifecycle to eradicate supply chain attacks in the payment process. Trustmi removes manual data entry and other tasks that often result in errors and protects vendor information from bad actors. This enables collaboration between departments and validates vendor data, which streamlines change processes. Trustmi’s self-service portal modernizes vendor enrollment and enables customers to fully configure their vendor payment workflows to fit their preferred processes. The vendor onboarding module also provides full bank account validation with Trustmi Certify, a solution that authenticates the identity of vendors and validates the legitimacy of their bank accounts. This out-of-band identity validation solution replaces the time-consuming and vulnerable call-back procedure, enabling vendors to seamlessly and securely connect to their bank accounts for real-time validation.

Trustmi’s Payment Flows module proactively detects common human errors in the business payment process to ensure accurate and on-time payments to the right vendor. Payment Flows improves efficiency and provides finance teams with automated, end-to-end visibility of their payment approval workflow, including invoices, vendors, and internal approvals at every step across the approval chain. The Payment Flows module enforces compliance controls in the organization’s payment cycles to ensure that internal processes are followed and that there are no violations like circumventing the segregation of duties.

Trustmi’s SOX Compliance solution establishes a payment and approval flow process baseline. By identifying legitimate patterns and highlighting anomalies, the solution allows organizations to validate their compliance requirements, enforce strict controls on new processes, and prevent SOX violations in real-time. The solution transforms the manual audit effort into an automated approach that simplifies audit preparations with robust reporting capabilities.

How we are different

- Trustmi is the only end-to-end business payment security solution that helps companies protect their bottom line by eliminating losses from cyberattacks, internal collusion, and human error and ensuring payments go to the right place.

- The Trustmi platform can be set up, calibrated, and deployed within one week to protect payments from fraudulent activity and delivers 0 false positives

- The Trustmi platform does not change or disrupt any internal processes or workflows so that finance teams can continue running their processes their way but still get full payment protection

Vote by Sharing

- Like

- Digg

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- SMS

- Viber

- Telegram

- Subscribe

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Each completed social share counts as a vote for this award nomination.