Photo Gallery

|

|

Viettel Financial Fraud Detection and Response

Additional Info

| Company | Viettel Cyber Security Company |

| Company size | 100 - 499 employees |

| Website | https://viettelcybersecurity.com/ |

NOMINATION HIGHLIGHTS

Viettel Financial Fraud Detection & Response is the pioneer in Vietnam providing banks and financial institutions with a solution that aims to mitigate monetary fraud and increase end-user’s satisfaction. We bring a comprehensive approach to those who are struggling to deal with losing credibility from their customers, which is believed as one of the biggest consequences of fraud attacks besides financial losses. In addition, we also prevent fraudster from taking advantage of promotional campaigns, new user development campaigns, etc. to protect the organization’s budget.

Concretely, there are four essential modules in our product:

– Detection: Create complex fraud detection scenarios using conditions on object’s profiles or the correlation conditions between the object’s behavior, combined with built-in profiling technology and risk scoring technology

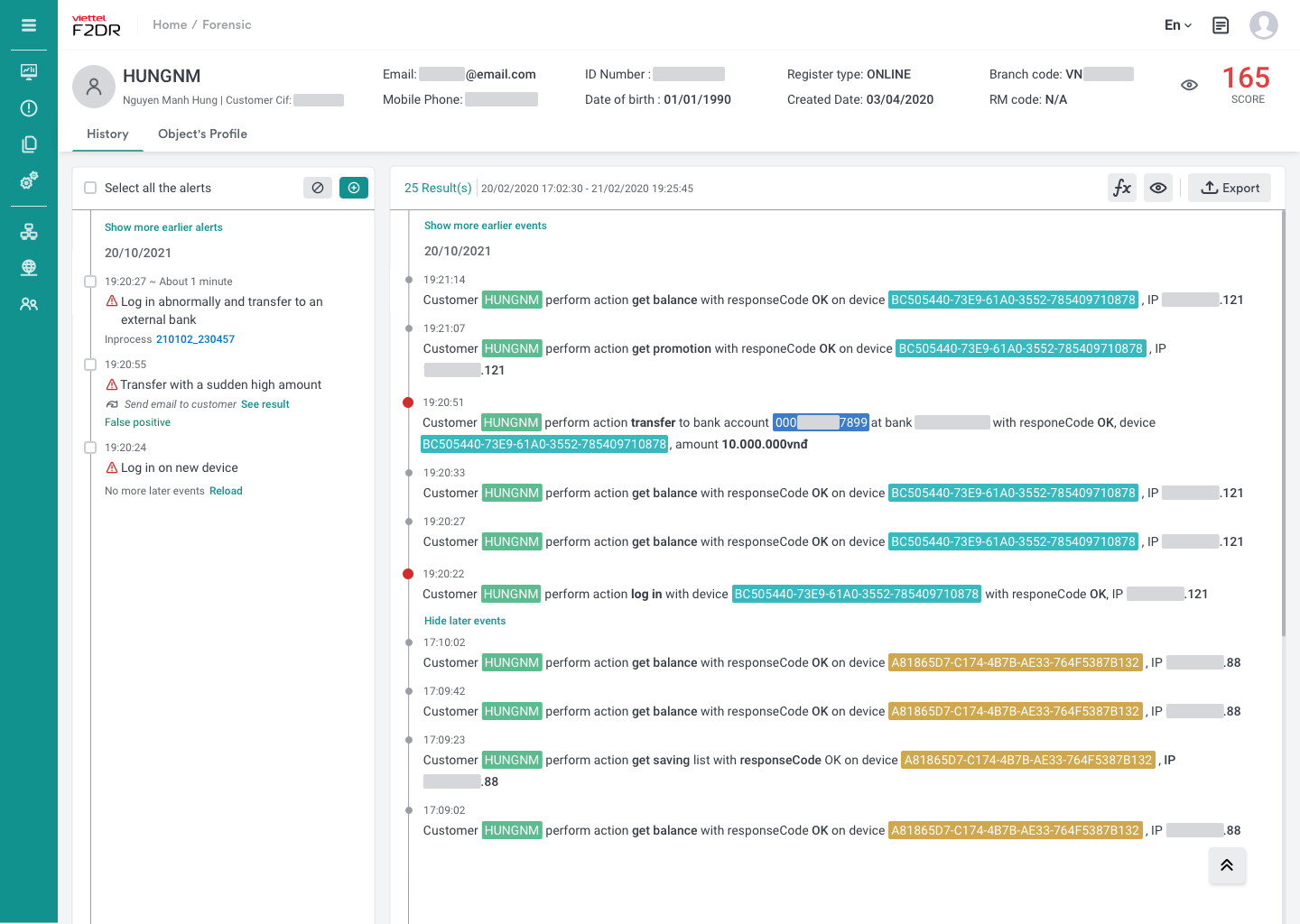

– Investigation: Analyze fraud from multiple perspectives on object’s historical data and object’s profile.

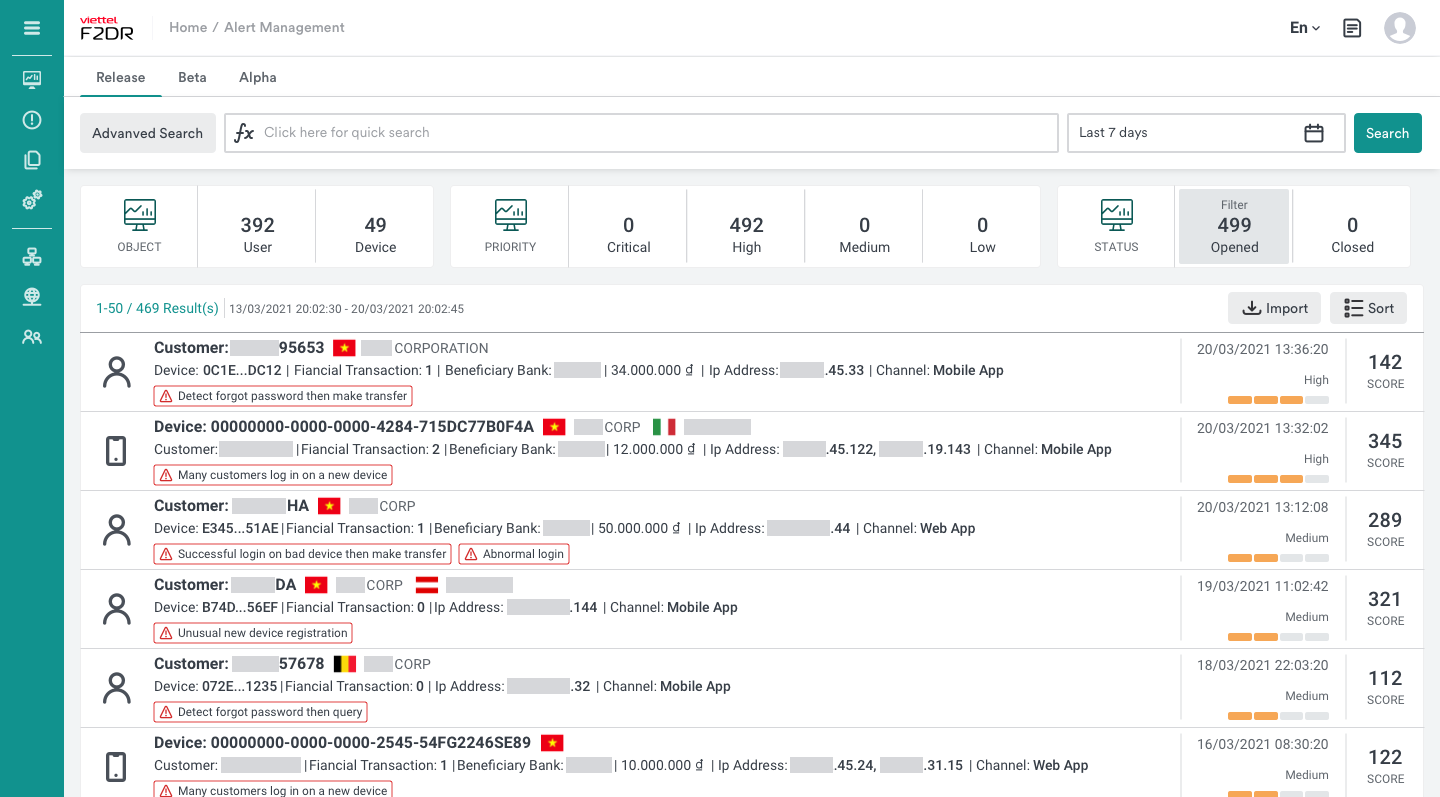

– Operation: Alert management and Case management

– Response: Build automated response scenarios to respond to the fraud incidents such as account locking, device blocking, blacklisting, sending notifications, etc. when object is alerted.

With these crucial elements, we wish to help enterprises to faster their operation process and effectively minimize the adverse impacts of fraudsters on their services. We suppose that our Detection module is the most significant feature with the capacity to address various types of frauds, such as Account Take Over, Promotion Abuse, etc. by using cutting-edge techniques such as Machine Learning, Risk Scoring, and Behavioral Analytics.

Moreover, since we are the biggest Internet Service Provider in Vietnam, it would be our strongest point among other competitors that we could harness the ISP advantage for early detection purposes. As a result, this would help us to prevent many fraud cases at the very beginning stage, when fraudster tries to steal important information from the customers.

How we are different

- Provides flexible and powerful fraud detection: Viettel Financial Fraud Detection & Response allows to create fraud detection scenarios from using simple conditions to complex conditions on object's profiles, or the correlation conditions between the object's behavior. In addition, the built-in profiling technology records any unusual behavior of users, devices, cards, etc. such as login time, usage frequency, login device, account beneficiary, transaction amount, ... to automatically assess the risk level of object in the session.

- Deliver a streamlined experience and seamlessly integration: The business flow is designed to be self-contained, including the development of fraud detection scenarios, the investigation and analysis of anomalous behavior, the process of build automated response scenarios. Providing a variety of investigative perspectives such as transaction history, transaction habits, risk history, related objects,... As soon as fraud is identified, our products assist in responding to the fraud incidents such as account locking, device blocking, blacklisting, sending notifications to users, etc.

- Early detection and timely response to fraud: Taking advantage of ISP and Threat Intelligence service, Viettel Financial Fraud Detection & Response uses information about bad ip addresses to access phishing domains; communications from phone numbers of scammers; exposed phone numbers, emails, cards and accounts in cyberspace,... in order to early detection and prevent account takeover happening at the very beginning stage, when fraudster tries to steal important information from the customers.

Vote by Sharing

- Like

- Digg

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- SMS

- Viber

- Telegram

- Subscribe

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Each completed social share counts as a vote for this award nomination.