Buguroo Behavioral Biometrics for 3D Secure

Photo Gallery

|

|

Buguroo Behavioral Biometrics for 3D Secure

Additional Info

| Company | buguroo Offensive Security S.L |

| Website | http://www.buguroo.com |

| Company size (employees) | 50 to 99 |

| Type of solution | Cloud/SaaS |

Overview

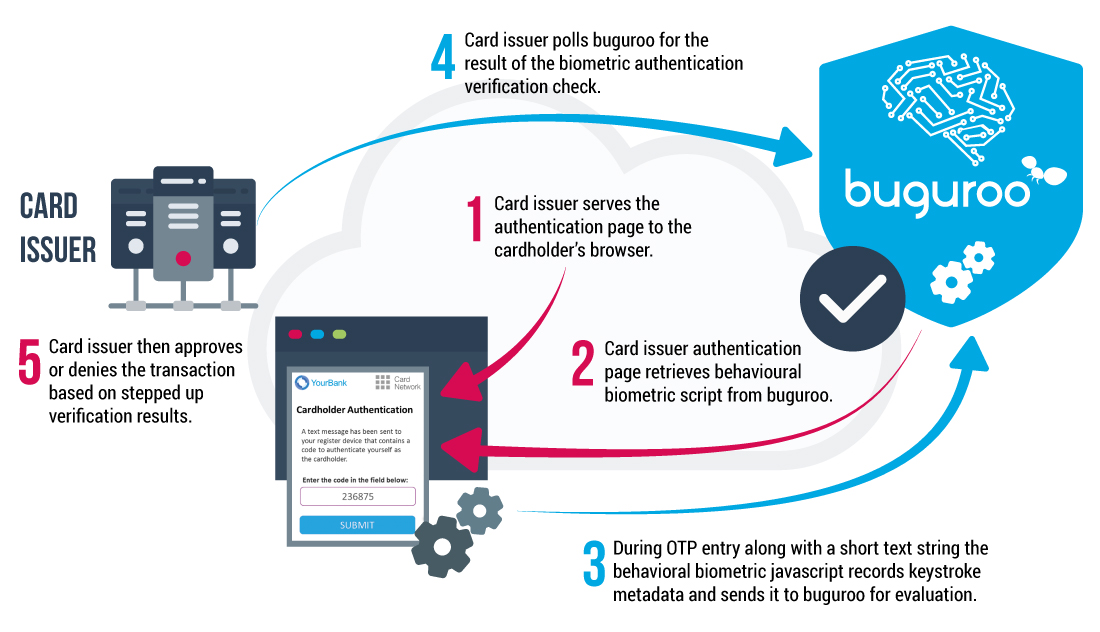

buguroo’s Behavioral Biometrics for 3D Secure solution is designed to block Card Not Present (CNP) fraud during e-commerce transactions using keystroke analysis. It relies on buguroo’s award-winning behavioral biometrics and deep learning-driven customer authentication technology and is used during the verification step of the 3D Secure payment authentication system for risky transactions.

Fraudsters are continuously developing extremely sophisticated techniques that seek to circumvent two-factor authentication challenges in the 3D Secure process, such as through SIM swapping scams which are specifically aimed at re-routing victims’ one-time passwords (OTP) to their own devices. Currently, card issuers are in a lose-lose situation: if they approve a risky transaction but fraud takes place, they are faced with chargeback liability – if they decline the purchase, they lose out on the sale or transaction processing fee. buguroo helps solve this complex issue through its application of behavioral biometrics analysis, enabling an additional layer of authentication completely invisibly to the consumer.

buguroo’s solution keeps the online transaction experience frictionless by introducing keystroke analysis into the multi-factor authentication step of the 3D Secure process. It collects biometric data from the customer at the point of the OTP challenge, where they are required to enter a short string of characters such as an email address. By applying deep learning technology to analyze typing rhythm, speed or cadence, a user can quickly be identified as a known customer or a fraudster. The resulting assessment is then reviewed by the card issuer to approve or deny the transaction with maximum certainty that the transaction is not fraudulent.

How we are different

1. Fraud protection leveraging the unique combination of behavioral biometrics and deep learning technology.

buguroo’s anti-fraud offering for banks is rooted in behavioral biometrics-based user authentication technology. buguroo creates unique ‘BionicIDs’ for each user as they access and move around in a bank’s system. It collects behavioral biometric data such as typing rhythm, mouse movements and scrolling speed to determine if users are who they say they are. When a user’s behavior doesn’t match up to their usual patterns of behavior, banks can respond to the threat and block the fraud. In the 3D Secure process, users’ keystrokes are compared to BionicIDs quickly and effectively to return an accurate risk evaluation to the card issuer. Deep learning means that the solution becomes increasingly accurate every time a transaction is processed.

2. Frictionless transaction experience for the user – maximum revenue for the issuer.

With buguroo’s unique 3D Secure offering, card issuers can rapidly recognize genuine customers and fraudsters, and safely approve or deny risky CNP transactions. This means issuers avoid chargeback liabilities due to compromised card information and minimize lost revenue. Layering buguroo’s solution with 3D Secure keeps legitimate customers and their money safe, without adding friction to the transaction experience or introducing an obtrusive or time-consuming verification element into the process. Transparent, rapid verification ensures a loyalty-boosting customer experience while preventing losses.

3. Provides Strong Customer Authentication for PSD2 and complies with GDPR.

With more stringent financial regulation on the horizon, buguroo’s behavioral biometrics technology provides rich fraud protection while enabling banks to remain compliant with data privacy (GDPR) and Strong Customer Authentication (PSD2) rules. Since personal information can be stolen, imitated or replicated, it is ineffective for fraud prevention. Instead, buguroo’s technology continuously scans users’ unique behavioral biometric patterns and compares them to their BionicIDs to provide accurate authentication.