DIGIPASS for Apps featuring Cronto technology and RASP capabilities

Nominated in the Category:

Photo Gallery

|

|

DIGIPASS for Apps featuring Cronto technology and RASP capabilities

Additional Info

| Company | VASCO Data Security |

| Company size | 500+ employees |

| Website | http://www.vasco.com |

NOMINATION HIGHLIGHTS

DIGIPASS for Apps helps prevent mobile fraud while enabling end-users to execute payments and exchange information in a seamless, highly convenient manner – the comprehensive mobile application security framework that secures all components of an application throughout the transaction process.

It lets the enterprise organization and its application developers secure and manage banking and financial transaction applications from provisioning through user activation.

It features:

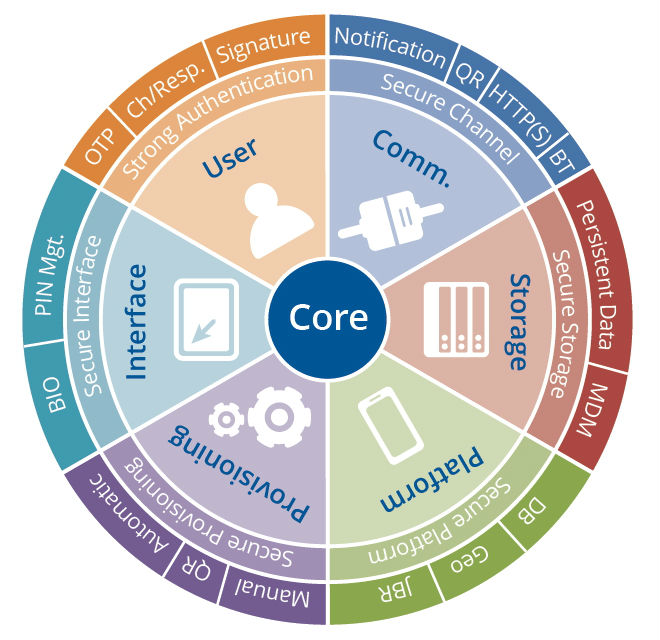

1. Application Security: state-of-the-art obfuscation, white box cryptography and coding increases security across all core application components (communication, storage, platform, provisioning, interface and authentication) with one integration.

2. User Authentication: extremely broad, flexible two-factor authentication (OTP and Signature) integrated via server or SaaS.

3. Risk Scoring: risk scoring (by user, platform and context elements) is injected into the OTP, enabling server-side risk-based analysis.

4. App-to-App Secure Channel: a secure channel for user and transaction authentication and validation adds an additional layer of protection.

5. Unique Cryptogram Authentication: The integrated CrontoSign technology sends consumers a high-definition color QR code for each transaction, providing a unique, secure authentication and visual transaction signing solution.

DIGIPASS for Apps’ Runtime Application Self Protection (RASP) capabilities proactively shield apps from malware, and maintain application integrity even if the environment is infected/hostile. RASP is intrinsic app security that controls execution, detecting and preventing real-time attacks.

Unlike similar solutions, it lets organizations drive powerful new levels of inter-connected mobile app security and intelligence across every level (communication, storage, platform, provisioning, interface and user), without performance lags or customer visibility.

It helps institutions and organizations establish the high level of trust required to deliver advanced mobile and multi-channel banking and finance services. Its friction-free user experience delivers the ultimate in user convenience to help drive both end-consumer satisfaction and new service adoption.

How we are different

• It is a comprehensive and exceptionally robust mobile application security framework that helps organizations protect all stages and application components their transaction process, from provisioning through end-user activation and ongoing usage.

• It incorporates many innovative, market-proven breakthroughs that are unique to VASCO and trusted by leading financial institutions around the world.

• The advanced levels of security, ease of use and convenience it lets organizations achieve supports their customer satisfaction, while its comprehensive framework helps these organizations continue to innovate new and better mobile features and customer benefits, helping them to sustain and expand upon their critical market advantages.

Vote by Sharing

- Like

- Digg

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- SMS

- Viber

- Telegram

- Subscribe

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Each completed social share counts as a vote for this award nomination.