Photo Gallery

|

|

Ethoca: A Global Solution to Fraud

Additional Info

| Company | Ethoca |

| Company size | 100 - 499 employees |

| Website | http://www.ethoca.com |

NOMINATION HIGHLIGHTS

Ethoca’s solutions leverage the power of sophisticated data sharing between payment card issuers (banks, credit unions, etc.) and ecommerce merchants to fight fraud around the world. The best part? All fraud prevented is cardholder confirmed, rather than suspected (which is how most fraud preventions solutions operate).

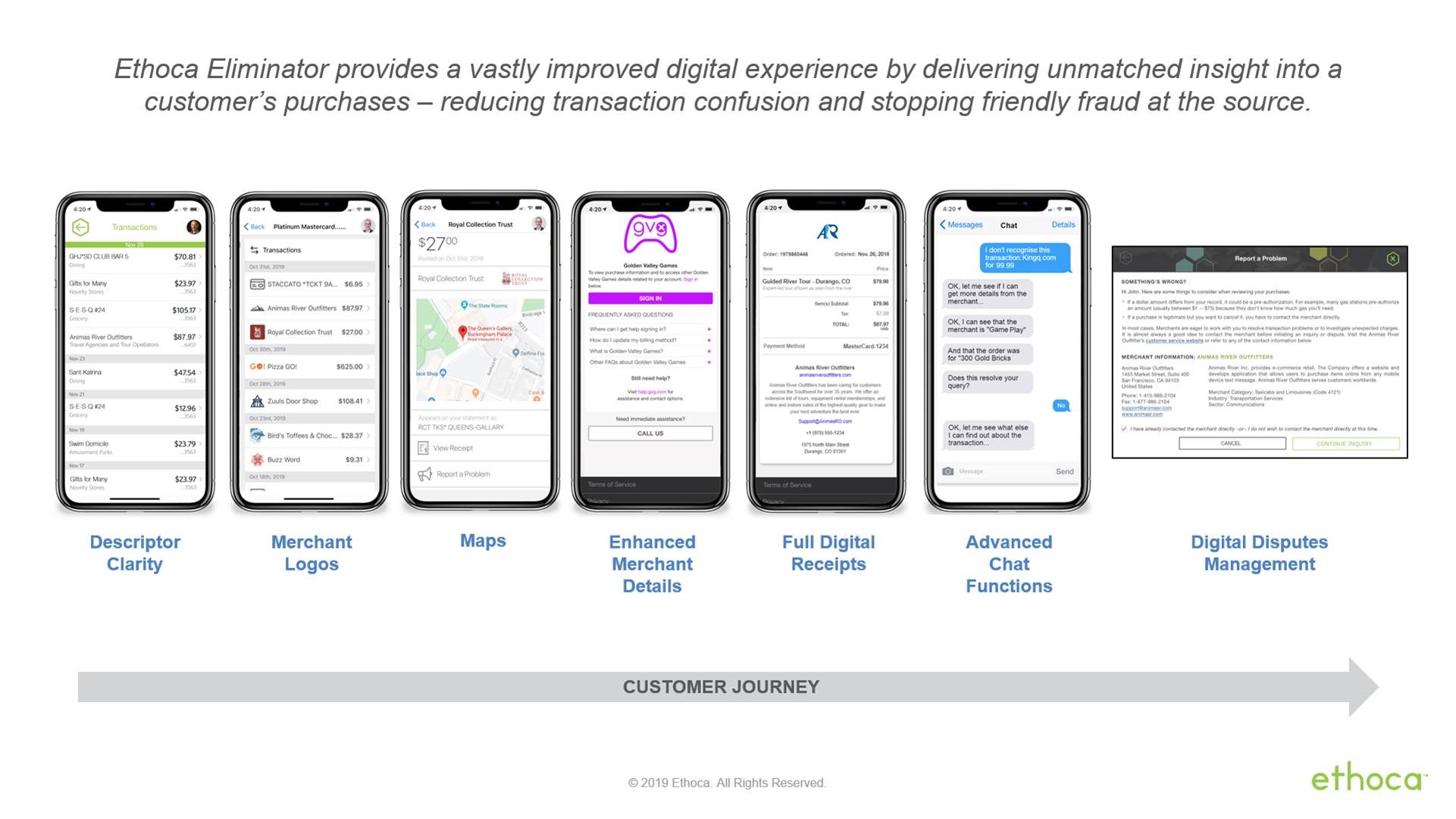

The first line of defense is Ethoca Eliminator – a friendly fraud mitigation solution that provides issuers and cardholders access to real time merchant intelligence, including itemized receipts, account history, merchant actions, refund status and more.

Eliminator can deflect disputes and false claims two ways. Cardholders can access detailed merchant data through their bank’s website or mobile app. Alternatively, issuers’ customer service agents can pull up merchant data for cardholders that proves transactions were legitimate. The result? Users have reported that they’re able to deflect upwards of 70% of incoming friendly fraud. This is fraud that cannot be stopped by other fraud preventions solutions on the market.

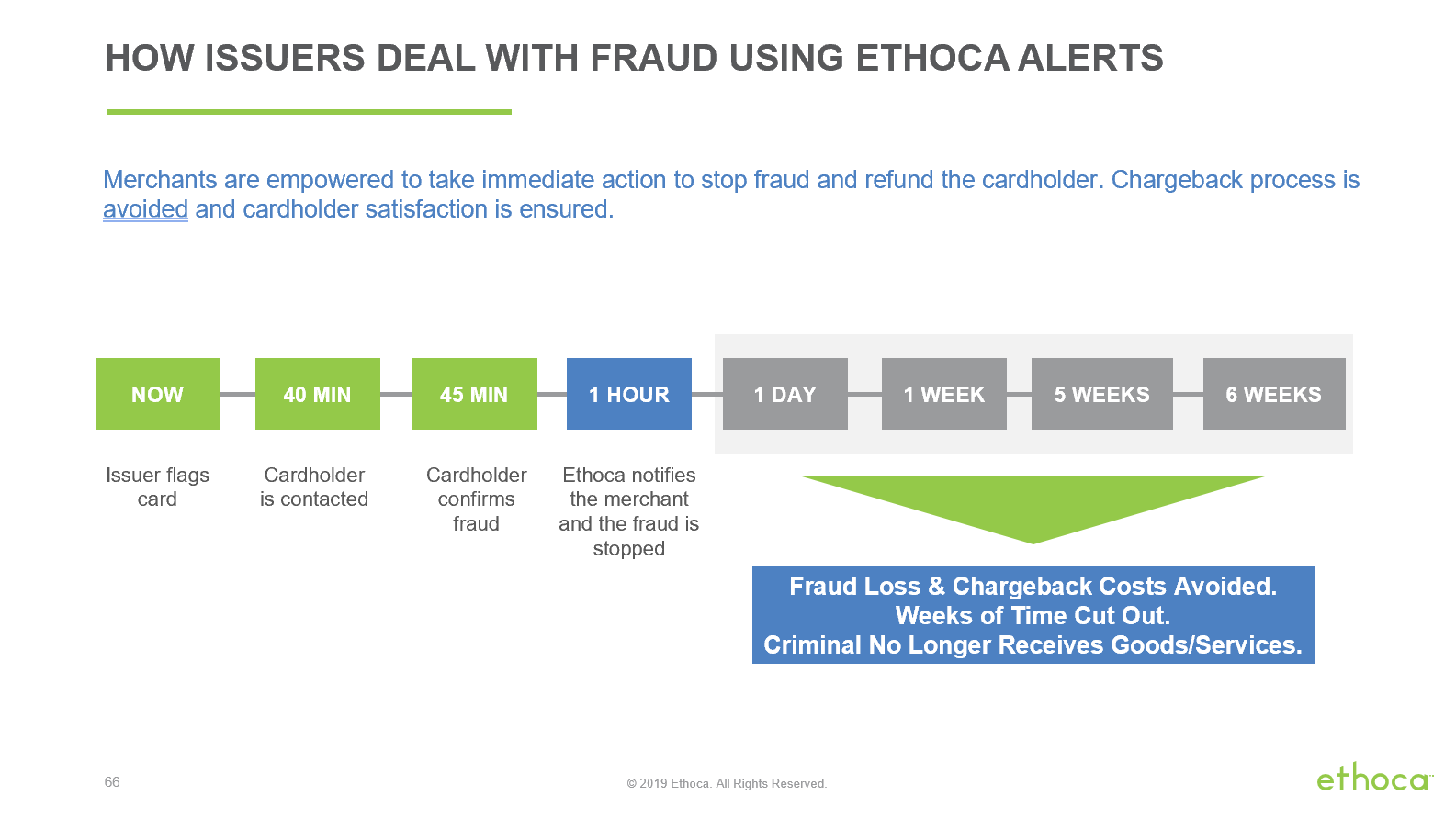

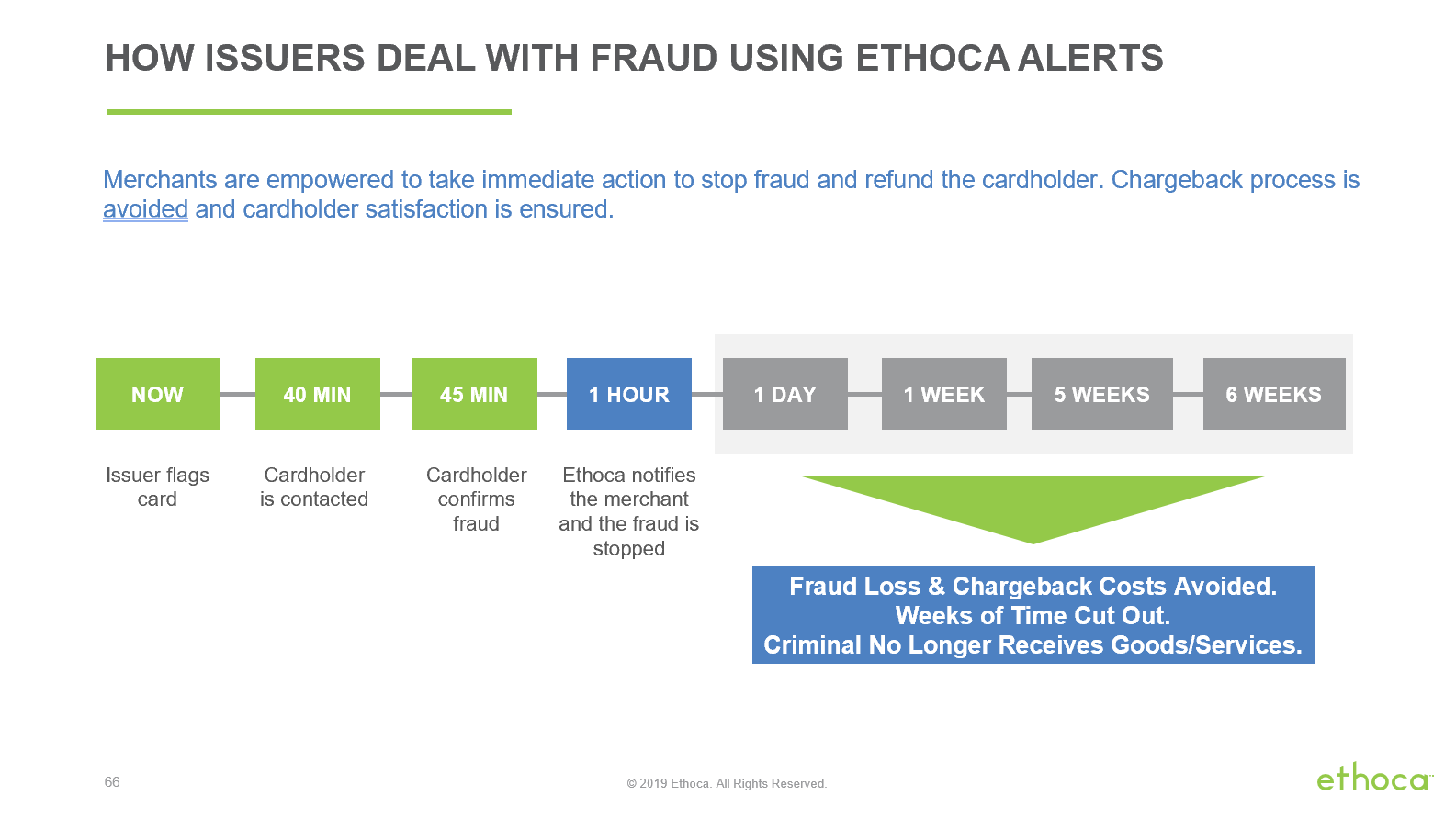

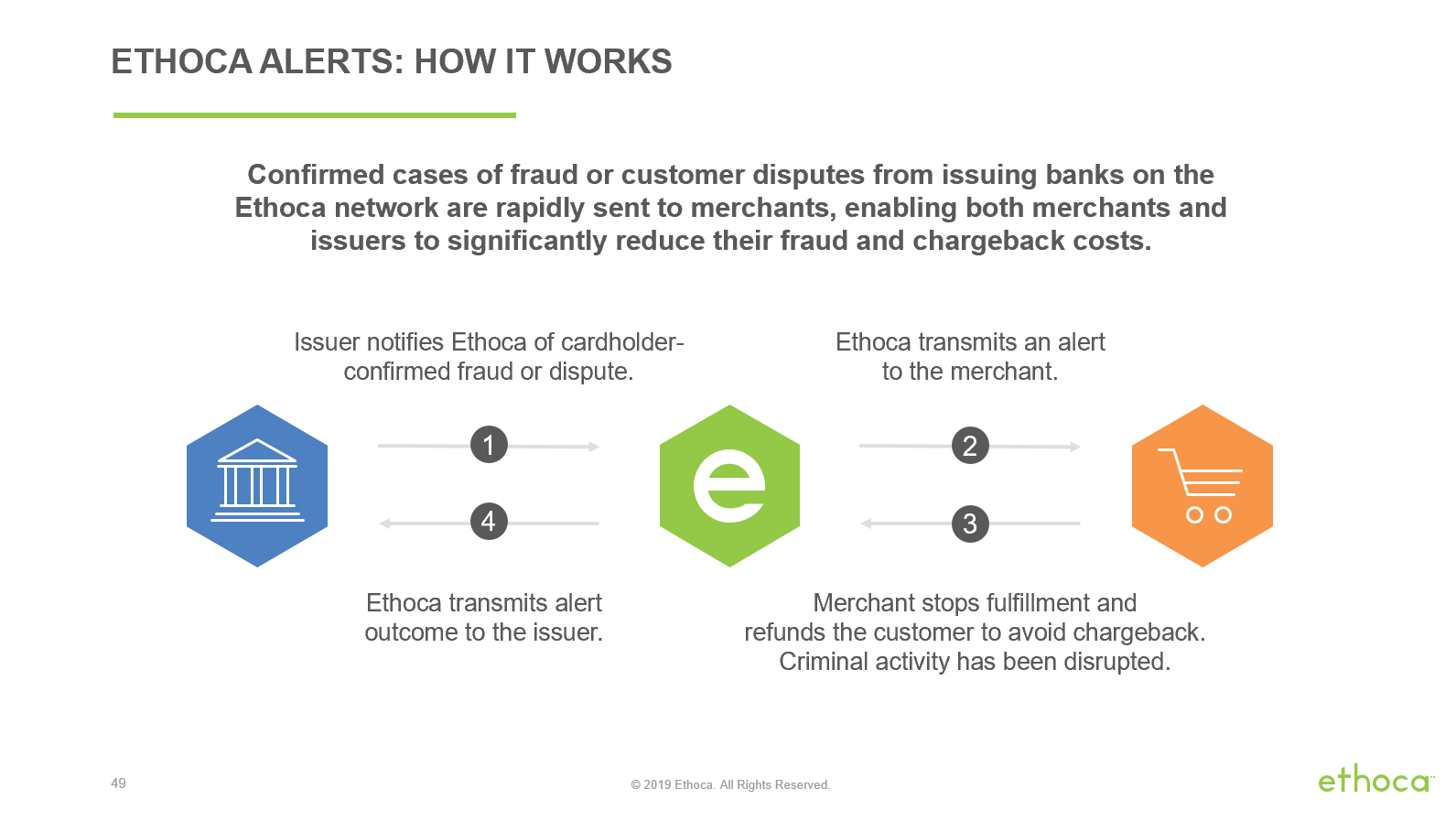

The second line of defense is Ethoca Alerts. This reduces the time for merchants to be alerted of confirmed fraud from weeks (through the chargeback process) to minutes. This gives them the opportunity to stop fulfillment of fraudulent orders before it’s too late. In the past 12 months participating merchants stopped 3,797,000+ incidents of fraud valued at more than $190,407,000+.

Issuers send confirmed fraud transactions to Ethoca, which we then send to merchants as an ‘Ethoca Alert’. When merchants receive an alert in their portal, they mark an outcome based on their ability to stop a fraudulent order. If they’re leveraging Ethoca Alerts through API, much of the process can be automated.

With Ethoca Alerts, physical goods merchants can stop up to 40% of fraud cases. For digital goods/services merchants, alerts are used to avoid chargebacks and shut down compromised accounts, stopping future losses.

How we are different

UNMATCHED NETWORK SIZE: Ethoca’s network is unmatched in size, scale and global reach. The merchant side of the network has grown 35% YOY and there are currently 243,000+ enabled merchant descriptors leveraging the Ethoca network.

How effective has Ethoca been for these merchants? Look at the fraud stopped in the past 12 months:

----Digital goods merchant: $49,002,000+

----Digital communications platform: $14,151,000+

----Discount retailer: $10,135,000+

----Dating site: $3,945,000+

----National Airline: $2,431,000+

----Ticket merchant: $2,050,000+

----Accommodations reseller: $1,909,000+

EXPANSIVE GLOBAL REACH: There are now 5086 issuers on the Ethoca network making it the best source of confirmed fraud data. This includes:

----9 of the Top 10 US Issuers

----8 of the Top 10 Canadian Issuers

----10 of the Top 15 UK Issuers

----2 of the Top 5 Mexican Issuers

----6 of the Top 10 Australian Issuers

As a result of this global coverage we have been able to successfully prevent the following value of fraud in a 12-month period in these regions:

----North America: $155,628,300+

----Asia-Pacific: $16,680,600+

----Europe: $15,279,700+

----Latin-America: $3,378,700+

These results are incredibly difficult to match for any comparable solution.

FRAUD DATA ADVANTAGE: Ethoca’s extensive fraud data advantage cements our position with the key merchant brands in physical goods, air travel and retail and leads to the prevention of a vast quantity of chargebacks as well as fraud. How much fraud? In November 2019 alone, we were able to stop $16,320,300+.

As the size of the network increases, so too does the fraud-stopping power of our solutions. Meaning network participants get increasing value year over year.

Vote by Sharing

- Like

- Digg

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- SMS

- Viber

- Telegram

- Subscribe

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Each completed social share counts as a vote for this award nomination.