Photo Gallery

|

|

VASCO DIGIPASS® for Apps

Additional Info

| Company | VASCO Data Security |

| Company size | 500 - 999 employees |

| Website | http://www.vasco.com |

NOMINATION HIGHLIGHTS

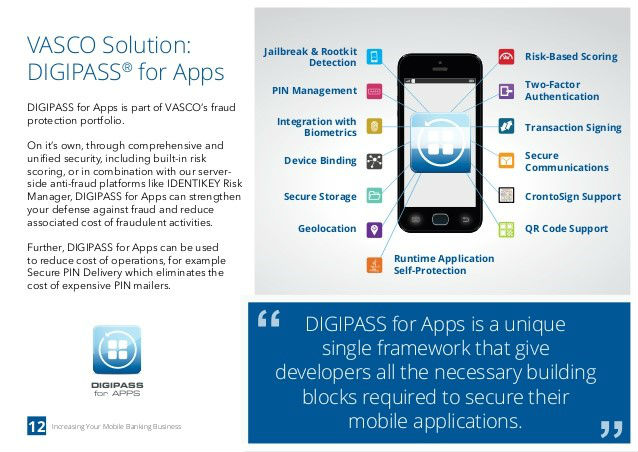

DIGIPASS for Apps is a comprehensive software development kit (SDK) that natively integrates application security, multi-factor authentication, electronic signing and e-signatures into mobile applications.

No other mobile application security solution provides a single framework with as extensive a library of APIs and integrated features that ensure strong security and optimal user experience.

VASCO’s DIGIPASS for Apps includes the following features:

• Runtime Application Self-Protection (RASP) to dynamically monitor app execution to detect and prevent attacks on mobile apps

• Advanced Biometrics (e.g., ”selfie” and fingerprint authentication) to accurately validate the customer’s identity before the transaction can be completed

• E-signatures to capture legal intent and a detailed audit trail of how, when, and where the transaction took place

• Fraud protection utilizing a client-based risk score of the customer and transaction in order to reduce the likelihood of fraud

VASCO’s DIGIPASS for Apps includes eSignLive’s mobile SDK to allow organizations to securely capture legally binding signatures on contracts and other business-critical documents. Leveraging best-in-class technologies such as biometrics and e-signatures gives organizations the ability to deliver secure yet convenient mobile onboarding experiences.

Organizations can also build VASCO’s “Smile & Sign” SDK into an existing banking app to upsell to customers, enabling them to apply for instant access to credit or other financing. To do so, the customer opens the financial institution’s app and enters the amount of credit desired, then takes a “selfie” and signs on the phone’s screen. At the recent Finovate conference, Smile & Sign was one of only 70 innovations from around the world selected for demonstration in front of more than 1,500 fintech innovators

With DIGIPASS for Apps, all core components of the mobile application are encrypted (i.e. communication, storage, platform, provisioning, interface and user), and protection is easily integrated, without performance disruptions or end user visibility.

How we are different

• Industry-Leading Security Prevents Fraud - Extensive authentication options, anti-malware technology and client risk scoring capabilities effectively mitigate fraud and insulate consumers from hacking attacks. This ultimately reduces fraud exposure for the business (contributing to the bottom line) and improving the consumer experience in the process.

• Speed to Market Drives Growth - With DIGIPASS for Apps, app developers don’t need to be security experts. By delivering a complete mobile security solution in SDK form, developers can focus on enhancing the business capabilities of their applications, and accelerating time to market for revenue generating application features.

• User Experience Ensures Loyalty - By elevating trust and improving user experience, organizations can securely offer more services via mobile, improve capabilities for other banking channels in the process and create more loyal customers.

Vote by Sharing

- Like

- Digg

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- SMS

- Viber

- Telegram

- Subscribe

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Each completed social share counts as a vote for this award nomination.