Photo Gallery

|

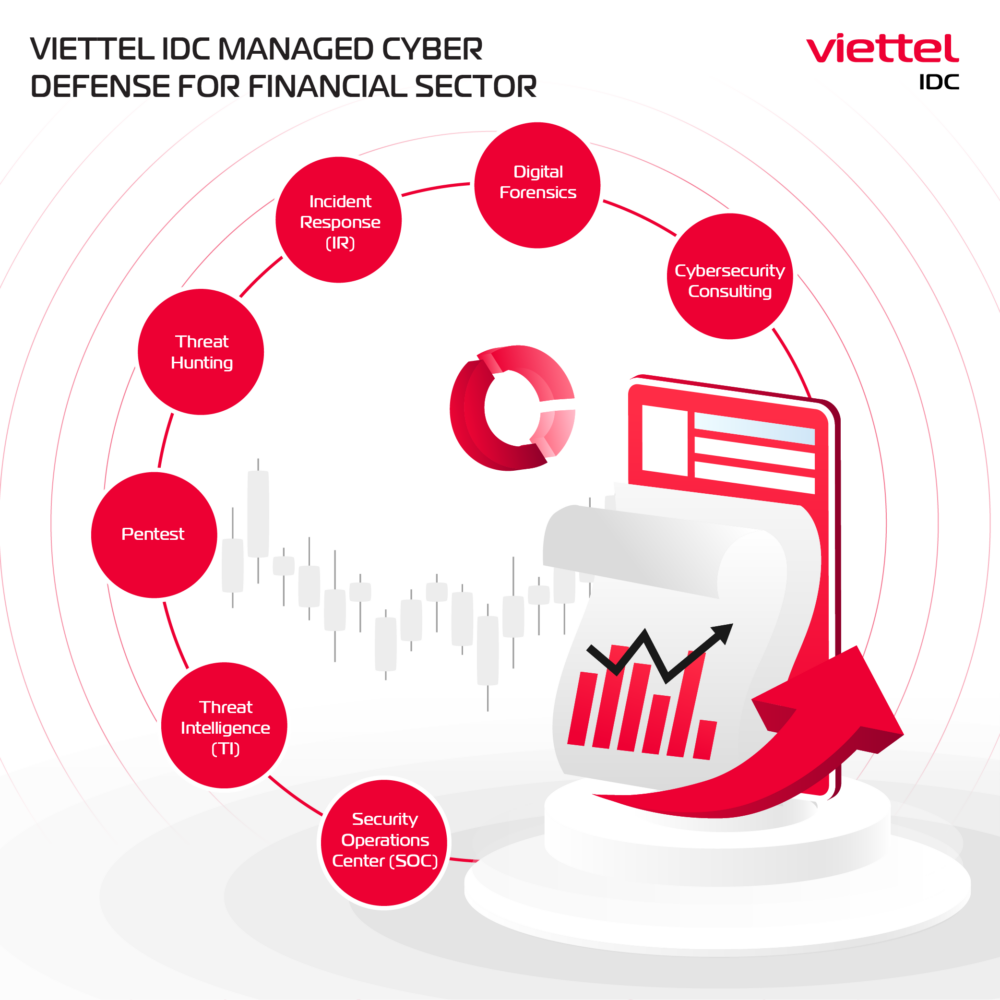

Viettel IDC Managed Cyber Defense for Finance Sector

Additional Info

| Company | Viettel IDC |

| Company size | 500 - 999 employees |

| World Region | Asia |

| Website | https://viettelidc.com.vn/ |

NOMINATION HIGHLIGHTS

We are a leading cybersecurity provider offering a comprehensive suite of security services including Security Operations Center (SOC), Threat Intelligence (TI), Penetration Testing (Pentest), Threat Hunting, Incident Response (IR), Digital Forensics, and Cybersecurity Consulting.

As a trusted partner of leading financial and banking organizations in Vietnam, Viettel IDC Managed Cyber Defense for the Finance Sector helps them strengthen their defense capabilities against increasingly sophisticated cyber threats, ensuring secure operations, regulatory compliance, and the protection of critical data.

Notably, we provide cybersecurity solutions within our ecosystem to approximately 40% of the top financial enterprises in Vietnam.

🔹SOC Monitoring Services

We deliver SOC monitoring services powered by the OpenXDR platform, integrating cutting-edge technologies such as Artificial Intelligence (AI), Machine Learning, and Next-Gen SIEM. Tailored for the financial and banking sector, our SOC system enables early detection of intrusion and attack indicators, allowing for timely intervention to mitigate incidents and protect organizational reputation.

🔹Threat Intelligence (TI) Services

Our threat intelligence system is the largest in Vietnam, aggregating data from reputable global sources to provide in-depth insights into cyberattack campaigns targeting banking systems. This intelligence-driven approach enables financial institutions to proactively identify and neutralize phishing attacks and advanced persistent threats (APTs) that could jeopardize their operations.

🔹Pentest, Threat Hunting, IR, Digital Forensics, and Cybersecurity Consulting Services

We offer comprehensive penetration testing, data extraction, and security incident analysis services for banks. Our team of certified experts—including CISSP, CHFI, OSCP, and OSWE—stands ready to advise and establish optimal cybersecurity strategies, ensuring robust protection for financial institutions.

Key Capabilities / Features

🔹 SOC-as-a-Service for Financial Institutions

24/7 Security Operations Center (SOC) powered by Open XDR, AI, and Next-Gen SIEM, providing real-time threat detection and automated response. Our SOC helps banks and financial institutions proactively defend against sophisticated cyber threats, including account takeover (ATO), insider threats, and financial fraud.

🔹 Threat Intelligence (TI) for Financial Cybercrime

Vietnam’s largest threat intelligence network aggregates data from global sources to provide deep insights into cyberattack campaigns targeting the banking sector. Our intelligence-driven approach enables early detection and mitigation of phishing attacks, APT threats, banking malware (e.g., Dridex, Emotet), and fraudulent transactions.

🔹 Advanced Penetration Testing & Threat Hunting

Industry-specific penetration testing for core banking systems, payment gateways, and financial APIs to identify vulnerabilities before cybercriminals can exploit them. Red Team/Blue Team exercises simulate real-world attack scenarios, ensuring financial institutions meet security benchmarks.

🔹 Incident Response & Digital Forensics for Financial Breaches

Rapid incident response services specialized for financial data breaches, ransomware attacks, and insider threats. Digital forensic analysis ensures accurate threat attribution, root cause identification, and compliance with financial regulatory requirements.

🔹 Cybersecurity Consulting & Compliance for Banking Regulations

Expert advisory from certified professionals (CISSP, CHFI, OSCP, OSWE) to help financial institutions develop cybersecurity frameworks that comply with PCI DSS, ISO 27001, GDPR, and local banking security regulations. Our consulting services also cover SWIFT CSP compliance and secure mobile banking strategies.

🔹 Adaptive Security & Risk-Based Authentication

Context-aware authentication that dynamically adjusts security controls based on user behavior, device trust level, and transaction risk to prevent unauthorized access and payment fraud.

🔹 Integration with Financial Security Ecosystems

Seamless integration with banking security solutions, including SIEM, SOAR, EDR, and fraud detection platforms. Compatible with major cloud providers (AWS, Azure, Google Cloud) and core banking systems to provide a holistic security posture.

How we are different

🔹 Strategic Partnerships & Advanced Technology

As one of Vietnam’s leading Managed Security Services Providers (MSSP), we collaborate with top global security vendors to deliver cutting-edge solutions that safeguard customer data and electronic payment systems for financial institutions.

Viettel IDC Managed Cyber Defense for the Finance Sector provides multi-layered protection, including Prevention, Detection, Response, and Incident Response (IR) services — enabling rapid incident handling, minimizing damages, and restoring systems to a secure state.

In addition, we offer Consulting & Improvement services to help clients enhance their security posture by identifying vulnerabilities and weaknesses. Based on these findings, we provide tailored recommendations, including remediation plans and proactive solutions to protect their systems and valuable assets.

🔹 Specialized Monitoring & Protection for Financial Institutions

Beyond 24/7 monitoring, we continuously optimize security systems with:

Custom security rule sets tailored to each organization’s unique needs, ensuring flexibility and adaptability.

Advanced risk monitoring models to proactively detect and mitigate evolving cyber threats, protecting customer data.

🔹 Security Advisory & Regulatory Compliance

We not only provide security solutions but also offer expert cybersecurity consulting to help financial institutions:

Develop a comprehensive security roadmap to defend against targeted cyberattacks.

Ensure compliance with stringent financial security standards, including PCI-DSS, SWIFT CSP, ISO 27001, and regulations set by the State Bank of Vietnam.

Conduct security assessments for online transaction platforms, digital banking applications, and electronic payment systems.

With deep expertise and industry experience, we help financial institutions minimize risks and maintain secure, uninterrupted business operations.

Vote by Sharing

- Like

- Digg

- Tumblr

- VKontakte

- Buffer

- Love This

- Odnoklassniki

- Meneame

- Blogger

- Amazon

- Yahoo Mail

- Gmail

- AOL

- Newsvine

- HackerNews

- Evernote

- MySpace

- Mail.ru

- Viadeo

- Line

- Comments

- SMS

- Viber

- Telegram

- Subscribe

- Facebook Messenger

- Kakao

- LiveJournal

- Yammer

- Edgar

- Fintel

- Mix

- Instapaper

- Copy Link

Each completed social share counts as a vote for this award nomination.