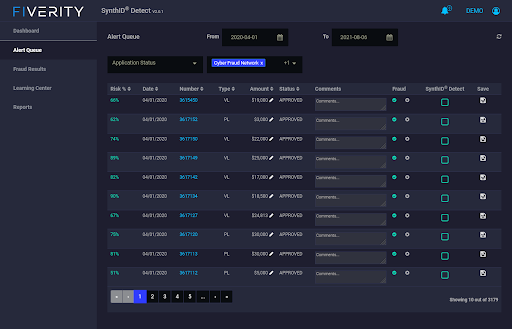

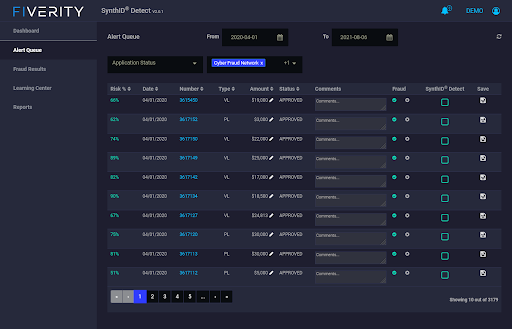

FiVerity Cyber Fraud Network

Photo Gallery

|

|

FiVerity Cyber Fraud Network

Additional Info

| Company | FiVerity |

| Website | http://www.fiverity.com |

| Company size (employees) | 10 to 49 |

| Type of solution | Cloud/SaaS |

Overview

FiVerity combines machine learning with fraud analysts’ expertise to combat the convergence of financial fraud and cyberattacks, including Synthetic Identity Fraud (SIF).

SIF is a fraud and cybersecurity crime responsible for a staggering amount of credit losses. In fact, the Federal Reserve says SIF is one of the fastest-growing types of financial crimes in the U.S., costing U.S. banks $20B in 2020. Global criminal organizations create these synthetic accounts from social media and compromised identities on the dark web.

Once criminals have a successful synthetic identity, they use it in multiple locations, in parallel, because the lack of communication between financial institutions means there’s no way to stop them. Many also play the long game, building the credentials, credit score and status of a fake account. This allows criminals to borrow large amounts of money with no intention of repaying it. Billions are then stolen to fund human trafficking, illegal drug production, and other crimes.

Although fraud and risk managers have been interested in sharing information on suspected fraudsters, a variety of legal, competitive and logistical concerns have prevented this. FiVerity’s Cyber Fraud Network assembles the collective knowledge of financial institutions, regulators, and law enforcement on cyberfraud. It facilitates the secure exchange of fraud intelligence between consumer lending institutions, while preserving the privacy of personally identifiable consumer information (PII).

The Cyber Fraud Network, which can be accessed through a simple and secure API integration, strengthens each user’s defense by alerting them to new and existing fraudulent activity detected throughout their network, while also providing ongoing defense. This multiplies the ability to identify – and learn from – new fraud patterns.

How we are different

FiVerity’s Cyber Fraud Network facilitates the secure exchange of fraud intelligence between consumer lending institutions, allowing collaboration to occur and fraud to be stopped in its tracks.

The Network’s unique “double-blind” approach splits the encryption key across members, so that no single institution holds the complete key to decrypt PII data.

With FiVerity, financial institutions maintain complete confidence in the security of their customer data, as the only companies that can validate a shared profile are the ones that already possess the corresponding PII.