LexisNexis® ThreatMetrix®

Photo Gallery

|

|

LexisNexis® ThreatMetrix®

Additional Info

| Company | LexisNexis® Risk Solutions |

| Website | risk.lexisnexis.com |

| Company size (employees) | 5,000 to 9,999 |

| Type of solution | Cloud/SaaS |

Overview

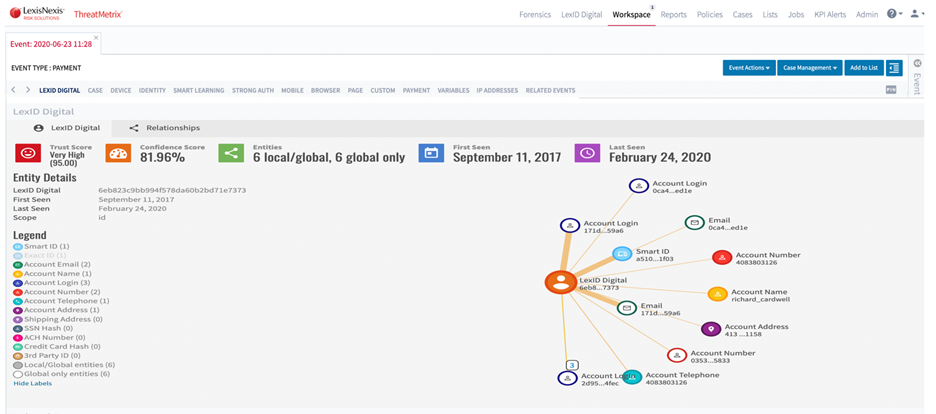

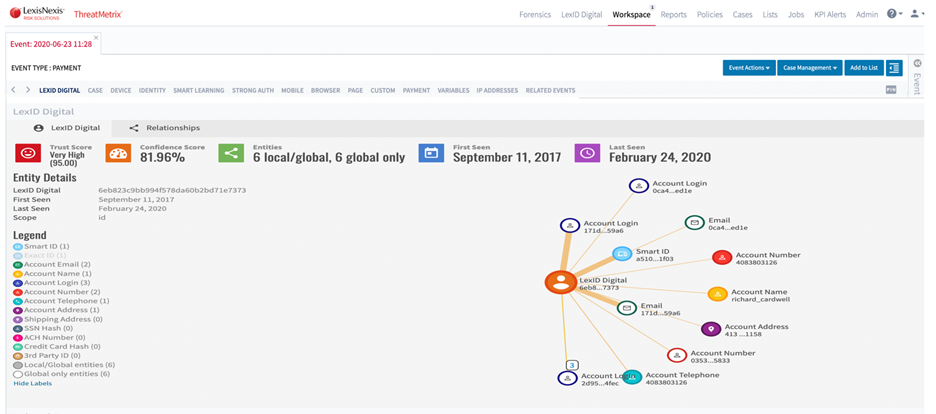

LexisNexis® ThreatMetrix® is an enterprise solution for digital identity intelligence and digital authentication that is trusted by over 1000 organizations worldwide, including leading financial institutions, to inform daily transaction decisions. By combining digital identity insights built from billions of transactions with leading analytic technology and embedded machine learning, our fraud prevention solutions unify decision analytics across the entire customer journey to help:

• Improve transaction security and refine personalization

• Minimize friction and reduce false positives

• Reduce abandoned transactions with online payment fraud detection

• Detect and prevent more fraud

• Accelerate conversions and maximize revenue

ThreatMetrix® connects a business to proven machine learning threat intelligence to help the business fully understand the digital DNA of users so it can spot suspicious behavior in near real time and make well-informed trust and identity decisions. This keeps valuable transactions in efficient motion while maximizing the effectiveness of critical fraud defenses and cybersecurity risk management processes with this dynamic, end-to-end decisioning platform.

ThreatMetrix was launched in 2005 and acquired by LexisNexis® Risk Solutions in 2018. LexisNexis ThreatMetrix was launched in 2019, which combined digital identity insights from ThreatMetrix with global verification, authentication and analytics for the physical identity from LexisNexis Risk Solutions to create a fraud prevention solution that unifies decision analytics across the customer journey.

How we are different

• LexisNexis ThreatMetrix identifies low risk consumers, recognizes good, returning customers and detects cyber threats and anomalous behavior of all users to better model future fraud risks by combining physical and digital identity insights to deliver a precise view of customer identity risk. We improve efficiency in detecting fraud, offer active and passive digital authentication and support the handling of unidentified fraud typologies. We also offer solutions that help solve regulatory and compliance challenges such as sanctions screening, PSD2 and CCPA. LexisNexis ThreatMetrix helps quickly answer critical questions across the customer lifecycle:

o New Account Origination – Is this a legitimate customer or fraudster?

o Account Logins - How can we authenticate account access with minimal friction?

o Payment Fraud Management - Should we consider this payment a high-risk geolocation?

• The LexisNexis® Digital Identity Network® uses industry-leading analytic technology and machine learning to aggregate tokenized intelligence related to high-risk behavior, including billions of logins, payments and new account creations every month from globally contributed transactions from a diverse cross-section of industries. With perspective across multiple industries including, e-commerce retail, financial services, telecom and gaming, the Digital Identity Network increases in currency and relevance with each contributory transaction. This also allows customers to share information securely to combat fraud through collective cooperation. Through our network and consortia model, customers within a similar industry and/or region can share negative and positive data attributes to select trusted member organizations to help inform and strengthen an immediate response to today’s rapidly emerging networked fraud threats.

• Launched in 2020, LexisNexis® Behavioral Biometrics can also be layered within the ThreatMetrix solution. Behavioral Biometrics delivers informed insights into the patterns and preferences behind trusted relationships to help enable a system to quickly recognize digital behavioral anomalies that signal fraud. This seamlessly supports a multi-factor fraud defense without adding friction by leveraging targeted visibility into risk