TransUnion’s BreachIQ™

Photo Gallery

|

TransUnion's BreachIQ™

Additional Info

| Company | TransUnion |

| Website | https://www.transunion.com/ |

| Company size (employees) | 10,000 or more |

| Headquarters Region | North America |

| Type of solution | Service |

Overview

TransUnion is modernizing fraud protection by delivering personalized risk insights and customized mitigation steps to address an individual’s unique risks in the wake of data compromise.

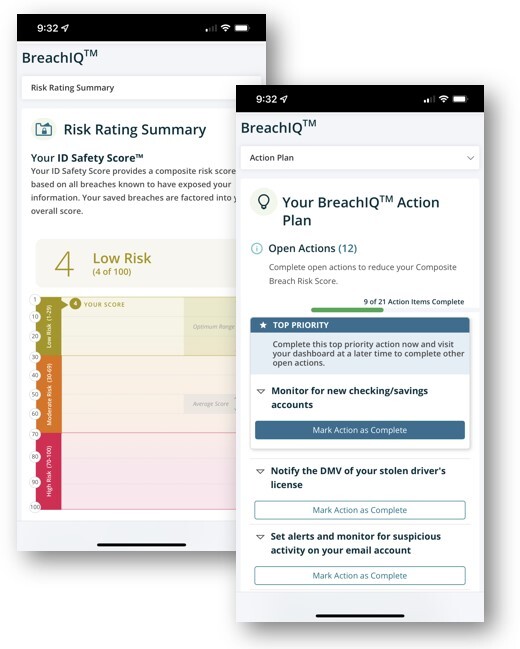

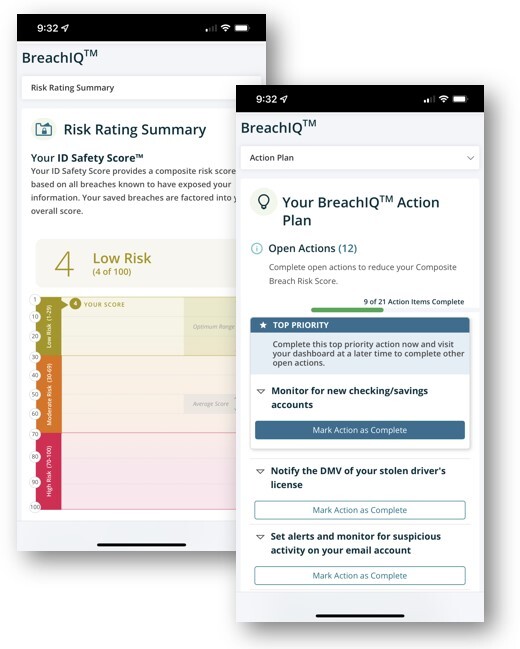

Utilizing a proprietary AI algorithm, BreachIQ analyzes more than 1,300 factors to assign a unique Breach Risk Score to each incident. BreachIQ’s AI also analyzes each consumer’s history of data compromise to build a personalized identity risk profile, and then prescribes a personalized mitigation action plan with recommendations from among 50 options. All of which is managed through TransUnion’s intuitive, web-based dashboard.

TransUnion’s AI solution monitors and analyzes the exposure of more than 60 personal data elements, from Social Security numbers and medical account information to passport numbers and financial accounts. Once compromised, individuals receive a rapid notification when these sensitive details have been associated with breach activity.

BreachIQ then reveals where the data was found, what specific breach it was associated with, what identity crimes it could enable, and prioritizes personalized action steps via an easy-to-use digital interface. Users are also presented with a dynamic Identity Safety Score that’s based on their own, unique risk profile. Similar to a credit score, they can monitor this score to see how following their customized action plan improves their identity protection and reduces their fraud risks.

Suppose a customer wants to know more about a specific breach. They can search our comprehensive Breach Universe, which aggregates the severity and risks from a proprietary database of every single publicly reported data breach, along with feeds from the dark web — providing greater visibility into the risk environment. More than four times as vast as the dark web alone, TransUnion’s Breach Universe covers the higher-risk breaches that are otherwise missed, allowing updates based on any new notifications that consumers receive.

How we are different

- All data breaches are not created equal: They differ in terms of the type, amount and sensitivity of the information stolen. Each exposure of personally identifiable information (PII) shapes a unique history for each victim, creating a unique pattern of risk. As a result, no two victims should consider the same factors when analyzing threats to their identity safety — yet historically, the response to breach exposure relies on a one-size-fits-all approach. BreachIQ’s hyper-personalized, holistic approach transforms identity protection and fraud risk mitigation: Individuals no longer must follow reactive, cookie-cutter suggestions because they now are empowered with proactive tools and strategies.

- BreachIQ’s proprietary AI algorithm delivers a distinctive method for detecting and responding to the fraud and identity risks consumers face when their data is compromised. Its hyper-personalized insights and mitigation steps is unique in specifying and prioritizing the actions victims need to take in the wake of a data breach. As a result, data from our call center reveals that BreachIQ users are significantly less likely to report an account compromise or identity compromise incident.

- This in-depth approach takes into consideration the various types of identity-related fraud that could result from stolen PII, including account takeover fraud, payment card fraud, advance fee schemes, medical ID theft, synthetic identity fraud, medical ID theft, synthetic identity fraud, tax refund fraud, and Social Security number misuse.